Finance

Welcome to this week’s Tranched newsletter.

In this edition, we analyse the recent frauds shaking private credit, unpack the deeper structural weaknesses behind them, and explore how blockchain technology can rebuild trust at the foundation of financial markets.

Finally, we show how Tranched is leading that transition with a protocol designed for real-time verification and institutional trust.

In the span of a few months, a pattern has started to take shape across the world of private and structured credit. A used-car lender in Texas, an auto-parts conglomerate in Connecticut, a telecom financier in New York, and even one of Europe’s largest banks have all reported losses tied to fraudulent receivables. The names differ, but the mechanism is almost identical: credit extended against assets that did not exist, or that were already pledged elsewhere.

The numbers are striking. Tricolor Holdings’ bankruptcy wiped out more than $1B in loans; First Brands Group left creditors facing losses on as much as $2.3B in receivables; HPS Investment Partners and BlackRock are pursuing recovery of roughly $500M linked to fabricated telecom invoices; and BNP Paribas recorded a €190M charge after discovering falsified receivables within its own markets division.

These incidents reveal a structural flaw in how institutions verify, monitor, and collateralise private credit. What the market needs is automated and continuous verification: an infrastructure where every pledged asset can be validated against a shared, tamper-proof record at the moment it moves.

The future of private credit will belong to those who can prove, not just assume, that their collateral is real.

The Shared Fault Line in Private Credit

Behind each recent fraud lies the same underlying weakness: the modern credit system has outgrown the infrastructure designed to keep it honest. Across banks, funds, and corporates, credit is being extended against information that cannot be independently verified.

The first common denominator is informational opacity. Receivables and loan portfolios exist as data, not as physical assets. Their value depends entirely on the integrity of digital records and borrower disclosures. Yet most verification occurs through manual sampling or periodic audits, long after the funding has been advanced. This delay creates windows where borrowers can alter, duplicate, or fabricate collateral without detection.

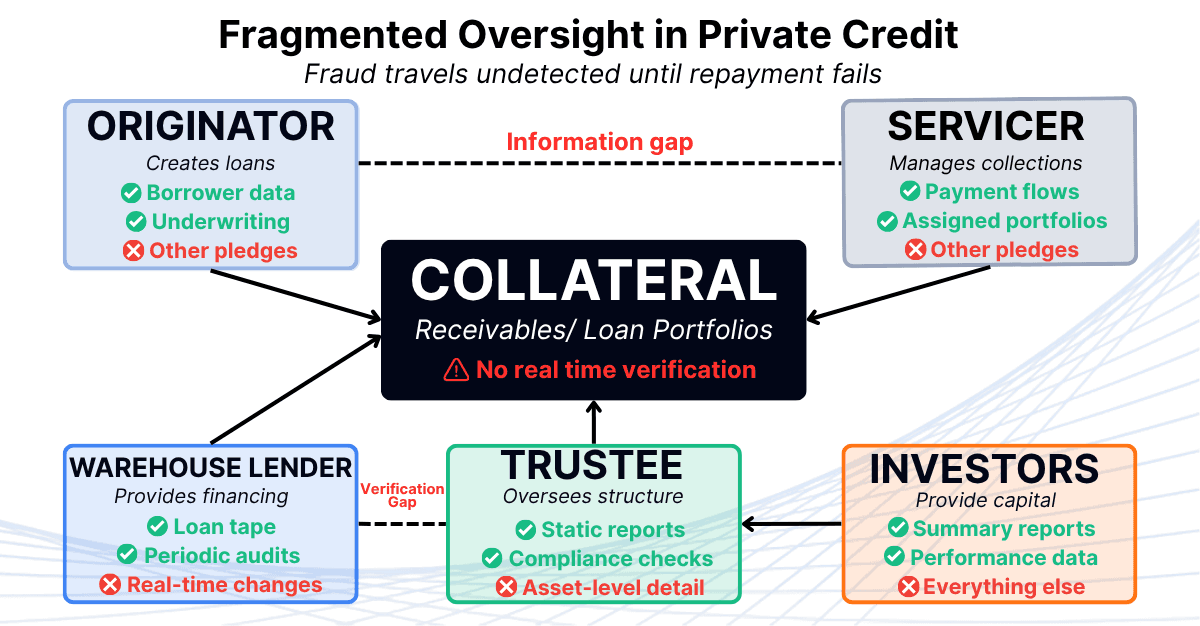

The second is fragmented oversight. Asset-based financing often involves multiple intermediaries: originators, servicers, warehouse lenders, trustees, and investors. Each holds only a partial view of the collateral, and no single participant can see the full picture in real time. When a receivable is pledged twice or a loan tape is falsified, the error travels through the system unnoticed until repayment fails. The absence of a unified ledger is what allows duplication to thrive.

The third is misaligned incentives. Originators are rewarded for loan volume, while lenders and investors rely on representations rather than validation. This creates a system that moves faster than it can verify itself. As competition for yield intensifies, verification becomes an operational cost to be minimised rather than a foundation of trust.

Finally, the reliance on outdated reporting systems compounds the problem. Spreadsheets, PDFs, and siloed databases remain the primary tools for managing trillions in receivables. These systems were built for static reporting, not for dynamic risk monitoring. They cannot detect when the same invoice appears in two portfolios or when cash flows deviate from expected performance.

Together, these weaknesses form a structural fault line running through modern credit markets. It is not confined to one geography or asset class. It is embedded in the way the industry records, verifies, and monitors collateral. The result is a system that appears transparent but is functionally opaque.

The Systemic Risk Behind Unverified Collateral

The breakdowns seen across Tricolor, First Brands, BlackRock, and BNP Paribas reveal how credit markets have come to rely on data they cannot independently verify. When that trust erodes, the impact moves beyond individual lenders and begins to affect the stability of the entire credit system.

Private credit has expanded to $1.5T globally, and is estimated to soar to $2.6T by 2029. Much of this capital circulates outside the banking perimeter, yet all participants depend on similar reporting frameworks and manual audits. A single flaw (ex. duplicated data, falsified invoices, or misreported cash flows) can therefore propagate across portfolios and jurisdictions simultaneously.

This is what makes data integrity a systemic issue. When collateral cannot be verified, confidence becomes the scarce commodity.

How Tranched turns Collateral into a Continuous Source of Truth

The problems exposed by Tricolor, First Brands, BlackRock, and BNP Paribas are painfully concrete: missing loan files, duplicated receivables, falsified tapes, and fragmented reporting. If the weakness is structural, the solution has to be structural as well. This is the starting point for how we design technology at Tranched.

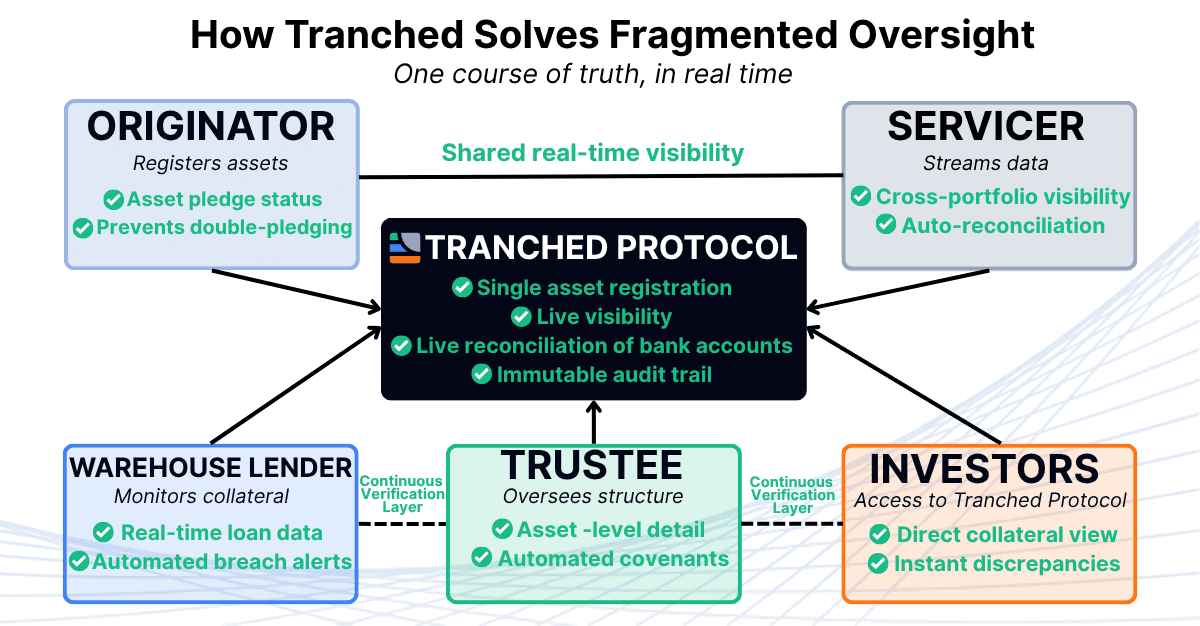

Single-asset registration at the source. Every loan, receivable, or advance that enters the Tranched platform is recorded as a unique, verifiable digital object. It is linked to a single capital structure on-chain, where its lifecycle, from origination to repayment, is tracked transparently. This removes ambiguity about asset ownership and eliminates the silent reuse of collateral across facilities. In practice, a receivable cannot exist in two places at once.

Continuous verification instead of delayed audits. Originators stream loan-level data directly into a shared ledger that updates automatically. Eligibility criteria, concentration limits, and advance rates are built into the smart-contract logic of each structure. If an asset breaches these limits, the system flags it immediately. Verification shifts from a backward-looking audit to a continuous control layer.

Unified oversight across all participants. Traditional securitisations depend on multiple intermediaries (ex. originators, warehouse lenders, trustees, and investors) each maintaining separate records. Tranched replaces this fragmentation with a single source of truth. Everyone views the same ledger, updated in real time. The moment a receivable moves or changes status, the update is visible to all authorised parties. Oversight stops being fragmented and becomes synchronised.

Automated covenant and performance testing. Covenants, portfolio triggers, and performance tests are encoded directly into the structure. Instead of manual recalculations each month, the system monitors these conditions continuously. If delinquencies rise above threshold or advance rates exceed limits, alerts are triggered automatically and cash-flow waterfalls adjust as programmed. This removes subjectivity and ensures that control is enforced by code.

Integrated reporting and reconciliation. Data silos and manual reporting are replaced by secure integrations with servicing systems and payment accounts. Loan repayments and recoveries are reconciled automatically against the on-chain record. Discrepancies or missed payments surface instantly instead of appearing months later in an audit. Auditors, regulators, and investors can be granted read access to the same immutable dataset, cutting validation time dramatically.

As adoption grows, Tranched sets a standard for how assets should be represented and pledged, allowing multiple institutions to fund on rails that share a common verification layer. As a result, the same receivable cannot be reused across portfolios without detection. Ultimately, with an increase in adoption, the network itself becomes a safeguard that limits the spread of fraud and misinformation across counterparties.

In practical terms, Tranched does not change the fundamentals of credit. Originators still underwrite, lenders still price risk, investors still decide where to allocate capital. What changes is the quality of the information those decisions sit on. Collateral stops being a story that has to be believed, and becomes a set of facts that can be checked continuously. That is the gap that failed in the four cases at the start of this newsletter, and it is the gap we are building to close.

Tranched’s Competitive Edge: The Blockchain Advantage

The structural redesign of credit infrastructure cannot rely on incremental fixes. It requires a new foundation built for transparency, automation, and interoperability. This is why Tranched is powered by blockchain technology. The decision is both forward-looking and practical. The future of finance is moving on-chain, and blockchain simultaneously resolves the inefficiencies that legacy financial systems can no longer absorb.

Shared visibility with controlled confidentiality. Legacy credit systems fragment data across multiple intermediaries, creating blind spots and reconciliation delays. On Tranched, all participants operate on a single synchronised ledger where collateral updates in real time. Access is permissioned, so each party sees only what is relevant to its role. This delivers full traceability without exposing sensitive borrower or portfolio data. The result is transparency where it matters and confidentiality where it counts.

Proven data integrity at the asset level. In legacy finance, documentation acts as proof of ownership, and that proof can be manipulated. On-chain architecture replaces trust with verifiable fact. Each asset registered on Tranched is recorded immutably, with its entire lifecycle traceable from origination to repayment. The permanence of these records eliminates double-pledging and falsified collateral. Verification becomes continuous, precise, and self-enforcing.

Automation of control and compliance. Smart-contract logic allows Tranched to automate the operational discipline of securitisation. Portfolio triggers, eligibility criteria, and advance-rate limits are executed automatically. When an exposure breaches its parameters, the system responds in real time, thus halting draws, alerting stakeholders, or adjusting waterfalls as programmed. Credit control evolves from a manual procedure into a built-in safeguard that operates at the speed of transactions.

This combination of visibility, integrity, and automation defines Tranched’s competitive edge. It is not only a more transparent infrastructure but a more efficient one, capable of reducing reconciliation costs, accelerating settlement, and expanding institutional trust at scale. As the financial economy migrates on-chain, the institutions that operate on verified, programmable systems will set the benchmark for the rest of the market. Tranched was built to lead that transition.

The Future Is Already Being Built

The pattern is clear. Markets that rely on trust eventually demand proof. The same will happen to private credit. Every institution now faces a choice: continue relying on fragmented systems that hide risk, or move to infrastructure that records and verifies value in real time.

At Tranched, we are not proposing a new theory of finance. It is about delivering the infrastructure that finance will require to survive at scale. Automated verification, transparent ownership, and programmable control are no longer optional features. They are the cost of entry for the next era of credit.

The difference between old and new finance will come down to information quality. Those who can prove the integrity of their assets will attract liquidity, confidence, and capital. Those who cannot will lose them.

The future of private credit is already on-chain. Tranched is building the rails that will carry it there.