Knowledge

Welcome to this week’s Tranched newsletter.

In this edition, we examine how stablecoins are forcing banks to rethink their role in payments, deposits, and capital markets, and why the response is far from uniform.

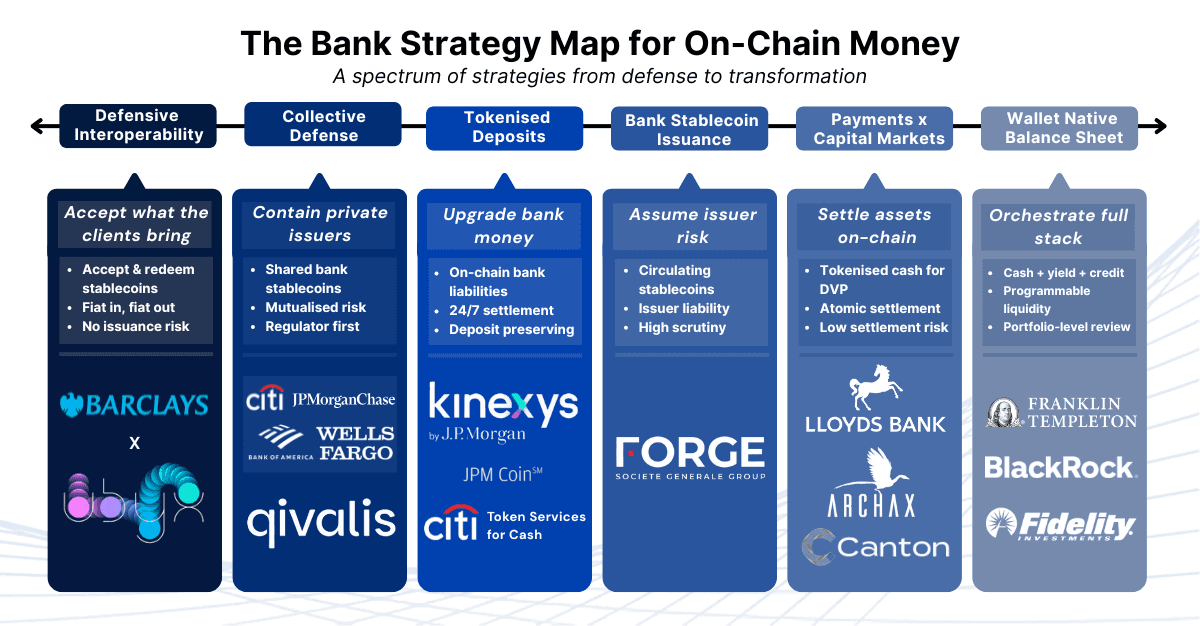

We map the full spectrum of bank strategies, from defensive interoperability to wallet-native balance sheets, and explain where the real competitive edge is emerging as money goes on-chain.

Stablecoins are forcing banks to confront an uncomfortable truth: if dollars can move 24/7 outside the banking perimeter, the deposit franchise starts to look like an interface, not a moat.

The conflict sits in plain sight. Stablecoins are designed to circulate in wallets and applications without returning to a bank balance sheet each time they change hands. That threatens a core banking advantage: low-cost, sticky funding.

European policymakers have started to say this out loud, warning that stablecoins can displace bank deposits and introduce run dynamics through reserve liquidations. The Financial Stability Board has flagged similar concerns around “deposit displacement” and the need for robust safeguards as stablecoin use cases expand.

Banks still have to play the game because the customer demand signal is no longer theoretical. Payments networks and enterprise platforms are turning stablecoin settlement into a production feature rather than a lab experiment.

Visa, for example, launched stablecoin settlement in the United States with initial banking participants including Cross River and Lead, framing it as operationally resilient “always-on” settlement without changing the consumer card experience.

Meanwhile, stablecoin acceptance is being “productised” for merchants: Stripe’s documentation and product materials now treat stablecoin payments as another global acceptance rail, settling into a Stripe balance in USD.

When corporates and platforms integrate these rails, banks face a simple choice: provide connectivity and risk controls, or watch flows route around them.

A practical map of bank strategies

What makes 2026 interesting is that banks are not responding with one strategy.

Their strategies sit on a spectrum that runs from basic interoperability, to issuing their own on-chain bank money, to using tokenised cash as the settlement leg for tokenised assets and funds.

The distinctions matter because they reveal what each institution is optimising for: deposit retention, client acquisition, balance sheet control, or a broader bet on programmable finance at scale.

Below, we outline the main stablecoin strategies banks are pursuing and why those choices matter for the future of payments, deposits, and capital markets.

1) Defensive - Interoperate first: accept, redeem, and settle stablecoins

The lowest-friction path is to become the trusted on and off-ramp for clients who already touch stablecoins, so deposits are recaptured rather than lost. This approach is deliberately low-commitment: no issuance risk, no balance-sheet exposure, and no attempt to set standards. Banks engage because clients force the issue, not because they want to own the money layer.

Barclays’ investment in Ubyx Inc. is a clean example of that posture: a clearing system designed to facilitate redemption across regulated stablecoins and tokenised deposits directly into bank accounts.

By enabling clearing and redemption across multiple regulated stablecoins into traditional bank accounts, the bank preserves relevance at the settlement layer without taking a view on which stablecoin “wins.” The objective is operational continuity, not monetary innovation.

2) Collective defense– bank consortia exploring shared stablecoins

Some banks have moved beyond bilateral interoperability by acting collectively, using consortia as a way to explore stablecoin issuance without forcing any single institution to step fully into the money layer.

In the United States, large banks including JPMorganChase, Bank of America, Citi and Wells Fargo have explored the idea of a jointly issued, bank-backed stablecoin as a response to the scale and distribution power of USDC-style instruments. These efforts are best understood as defensive and system-level: risk is mutualised, governance is shared, and regulatory engagement happens upfront rather than retroactively.

Europe is following a similar coordination path, albeit shaped by MiCA and a stronger emphasis on regulatory design. Qivalis brings together a consortium of 10 major banks, including BNP Paribas, ING, UniCredit, CaixaBank, Danske Bank, KBC Bank & Verzekering and others to develop a MiCA-compliant euro stablecoin for regulated on-chain payments and settlement. The purpose is to pool credibility and regulatory engagement so that a trusted, euro-denominated token can serve institutional and retail flows without fragmenting the market across competing proprietary issuers.

In both cases, consortia function as a risk-management tool. They allow banks to explore shared issuance frameworks and avoid fragmentation, without forcing an immediate, unilateral commitment to operating at the money layer.

3) Control the money - tokenised deposits and deposit tokens

A more assertive, but still bank-centric, response is to put commercial bank money itself on-chain. Tokenised deposits and deposit tokens preserve the deposit relationship while delivering many of the operational benefits associated with stablecoins: real-time settlement, programmability, and 24/7 availability.

Citi has been explicit about this direction, integrating Citi Token Services with 24/7 USD Clearing to enable always-on, multibank cross-border payments and liquidity management for institutional clients.

In the same vein, J.P. Morgan’s Kinexys Digital Payments and its deposit token JPM Coin are framed as 24/7, institution-to-institution settlement using tokenised bank deposits.

These instruments are not designed to circulate freely in wallets or DeFi protocols, but to support institutional payments, liquidity management, and internal or interbank settlement.

This strategy reflects a clear preference for upgrading bank liabilities rather than competing head-on with private money.

4) Issuance – single bank-backed stablecoins

Beyond coordination and tokenised deposits, a smaller set of banks has chosen to issue stablecoins directly. This is the highest-conviction strategy, because it concentrates issuance, reserve management, compliance, and reputational risk within a single institution. As a result, live bank-issued stablecoins remain rare and highly deliberate.

In Europe, Societe Generale - FORGE provides the clearest example. Its EUR-denominated stablecoin EURCV, alongside the USDCV initiative, is issued by a regulated banking group under MiCA and deployed on public blockchains. The emphasis is on regulatory clarity, issuer accountability, and tight control, even at the cost of slower scale and limited composability compared with non-bank issuers.

Single-bank issuance represents a conscious decision to operate directly at the money layer, rather than shaping it collectively or interfacing with it indirectly.

That distinction explains why so few banks have crossed this line, and why those that do treat stablecoin issuance as a strategic extension of their balance sheet, not an experimental payment feature.

5) Payments meet capital markets – tokenised cash for Delivery vs. Payment and settlement

Once you have tokenised cash, you can start settling real assets on-chain.

Lloyds Banking Group’s recent transaction is an early marker: tokenised deposits issued on Canton were used to purchase a tokenised UK gilt via Archax, with the proceeds ultimately ending up back in a standard bank account.

Whether this becomes routine depends on scaling the operational stack to match market infrastructure expectations. It is clear that institutions want the efficiency of atomic settlement and the risk reduction of delivery-versus-payment, while keeping the familiar regulatory perimeter around commercial bank money.

6) The wallet-native balance sheet – tokenised yield, credit, and liquidity

The end state is not payments alone, but balance sheets organised around wallets. Stablecoins and tokenised deposits provide mobility; yield-bearing assets follow.

Franklin Templeton’s Franklin OnChain U.S. Government Money Fund, launched in 2021, shows how regulated yield can sit natively on blockchain rails alongside cash-like instruments.

As tokenised cash becomes easier to move and settle, collateral, funds, and eventually programmable credit converge in the same interface. At that point, wallets stop being a crypto abstraction and become the front end of institutional balance sheets.

The future belongs to the gateways, not the issuers

The tension between stablecoins and bank-issued money does not resolve into a single dominant instrument. A stablecoin held in a wallet can circulate freely across exchanges, DeFi protocols, merchant payment flows, and cross-border settlement routes before it ever touches a bank account. Tokenised deposits, by contrast, remain a claim on a specific bank and are designed to pull value back inside the regulated perimeter. These instruments solve different problems, and clients will continue to choose whichever form of money best fits the transaction at hand.

That reality explains why the market is converging on coexistence rather than replacement. Banks are not trying to “kill” stablecoins, nor are stablecoins eliminating banks. The real challenge is operational: coexistence requires interoperability, credible risk management, and shared standards across multiple forms of tokenised money. This is where infrastructure and orchestration, rather than issuance alone, become decisive.

The investable takeaway is that cash legibility is becoming a competitive surface. Banks that can accept and redeem multiple forms of tokenised money, settle continuously with institutional-grade controls, and connect tokenised cash to tokenised assets will occupy the gateway position in an on-chain financial system. Those that cannot will still participate, but increasingly through correspondents and third parties, with less control, thinner margins, and growing dependency as volumes scale.

In that sense, stablecoins are not the end state. They are the forcing function. The banks that matter in the next phase will not be the ones that picked the “right” instrument early, but the ones that built the systems capable of handling all of them.