Global updates

Welcome to this week’s Tranched newsletter.

In this issue, we unpack why securitisation has re-emerged at Davos 2026 as a central lever for Europe’s competitiveness agenda, and why reviving it is less about deregulation than about infrastructure. We look at the structural financing gap Europe faces, what the post-crisis framework achieved and constrained, and why the next phase of securitisation needs modern, programmable rails to scale capital formation for the decade ahead.

Europe keeps returning to the same problem: huge pools of savings, an urgent need to invest, and a financing “plumbing” system that struggles to turn one into the other at scale.

That theme resurfaced at Davos 2026 in finance circles, alongside a broader recognition that competitiveness now hinges on capital formation as much as industrial policy.

The proximate trigger is hard infrastructure for the digital economy: AI compute, data centres, grids, and energy transition capex. The Financial Times framed it bluntly: Europe may need ~€3T over five years, yet lacks enough long-duration private capital flowing into these assets at speed.

This is not a “Europe is poor” story. It is a “Europe intermediates poorly” story.

The gap is structural: Europe’s capital is liquid, banked, and short-dated

Europe’s financial system is still dominated by deposits and bank balance sheets.

Household portfolios tilt materially towards cash and deposits relative to the US, which matters because deposits fund banks, but they do not automatically become long-term project finance, unless banks can efficiently distribute and recycle risk.

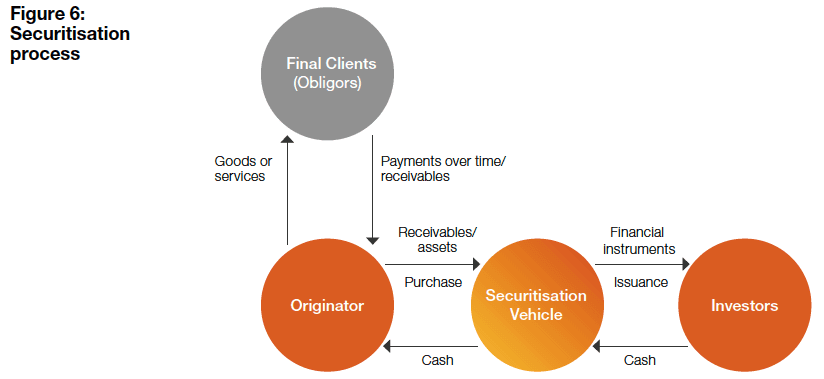

That is where securitisation is supposed to do heavy lifting: transform granular, amortising loan exposures into investable, risk-stratified instruments that match long-term capital (insurers, pensions, asset managers) with long-term assets.

The constraint is not appetite for securitisation, but the way it was rebuilt after 2008.

Europe’s post-crisis framework deliberately prioritised safety: high capital requirements, strict retention rules, and intensive due-diligence and reporting obligations.

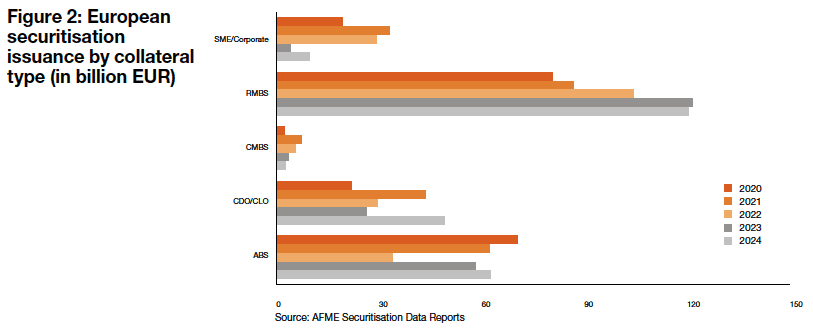

The result is a securitisation market that is resilient, but economically and operationally heavy. Deals are costly to originate, capital-intensive to hold, and viable mainly at scale.

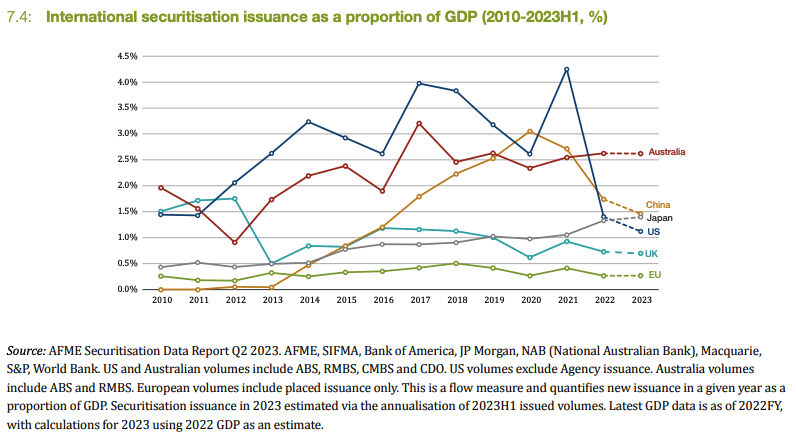

The consequences are visible in the data:

1) Data centre debt securitisation: In data-centre finance, a sector Europe explicitly wants to scale, the US has securitised roughly $63.6B of debt since 2018, while Europe has done less than $1B. The divergence is not about asset quality; it reflects how easily risk can be distributed through capital markets.

Source: Association for Financial Markets in Europe (AFME). Capital Markets Union Key Performance Indicators (CMU KPIs). AFME, November 2023.

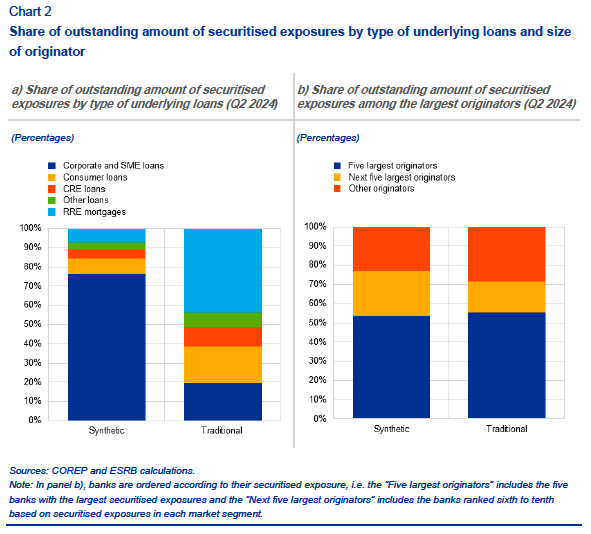

2) Market depth and concentration: In Europe. more than 80% of securitisation outstanding is backed by loans from five countries, and roughly 70% from the ten largest originator banking groups. Fixed operational and regulatory costs favour incumbents, limiting market depth, liquidity, and investor participation.

Source: European Systemic Risk Board (ESRB). Synthetic STS Securitisation: Recent Developments and Implications for Financial Stability. ESRB Report, May 2025.

3) Outstanding scale: AFME data puts European securitisation outstanding (including CLOs) around €1.25T (mid-2025). The issue is not existence, but scale and speed. Incremental growth is insufficient when Europe is trying to finance a new investment cycle in energy, digital infrastructure, and strategic autonomy.

Source: PwC. Securitisation in Luxembourg: A Comprehensive Guide. PwC Luxembourg, 2025 edition.

Brussels is already moving, because the competitiveness agenda needs it

The direction of travel is clear. In June 2025, the European Commission proposed a package to simplify and revitalise the EU securitisation framework under the Savings and Investments Union agenda.

Proposals include lower capital charges for high-quality STS tranches and easing parts of the capital calculation, paired with efforts to reduce operational burden.

This matters for investors for a simple reason: if the rules make high-quality securitisation capital-efficient for banks and investable for insurers, you get a larger, more stable buyer base. Liquidity improves, spreads compress, and the distribution engine starts working as a financing flywheel for the real economy.

There is a second-order effect too: risk transfer is already growing rapidly, especially via significant risk transfer (SRT) deals, alongside regulators signalling scrutiny.

That tension is healthy: Europe wants risk distribution, but it also wants underwriting discipline and transparent leverage.

The missing layer is operational: securitisation is still an analogue process in a digital investment race

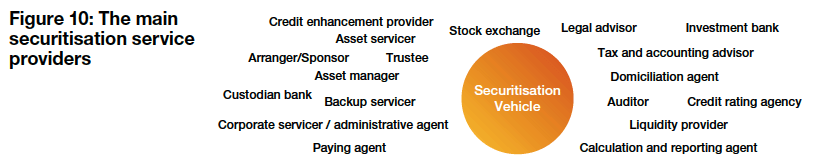

Even with policy reform, securitisation remains operationally fragmented:

asset-level data sits across originators, servicers, trustees, calculation agents, and data repositories

Source: PwC. Securitisation in Luxembourg: A Comprehensive Guide. PwC Luxembourg, 2025 edition.

investor reporting runs on periodic snapshots, not continuous risk telemetry

covenants, eligibility tests, and triggers are documented precisely, but enforced through batch workflows and reconciliation

secondary trading relies on slow settlement rails and manual controls

Source: PwC. Securitisation in Luxembourg: A Comprehensive Guide. PwC Luxembourg, 2025 edition.

This is where “infrastructure” becomes more than a metaphor. If Europe’s competitiveness problem is partly a plumbing problem, it is also a data problem and a process problem.

Davos 2026’s finance discussions echoed that bigger picture: de-risking, economic statecraft, and capital mobilisation increasingly depend on reliable, scalable market infrastructure.

What blockchain rails change in securitisation

On-chain rails are not a cosmetic wrapper around securities. Used correctly, they reduce the cost of trust.

In securitisation terms, that means four concrete upgrades:

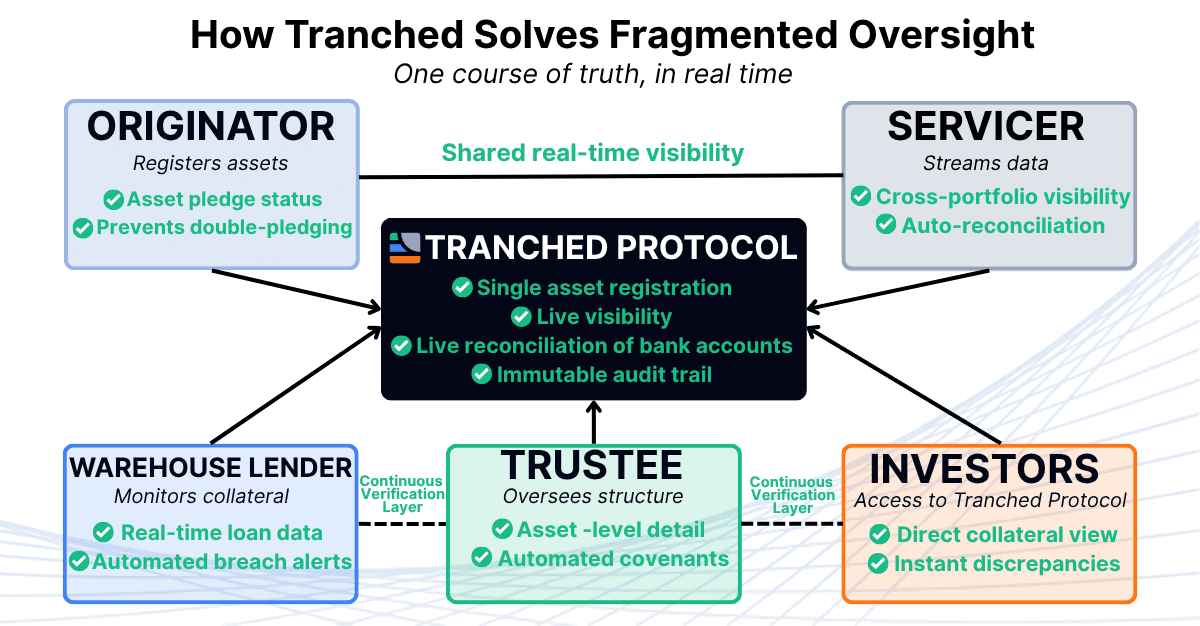

Continuous verification of collateral and eligibility: Instead of periodic eligibility testing and retroactive breach detection, collateral tapes can be updated and validated continuously, with rule-based checks that are auditable.

Programmable waterfalls and covenant enforcement: Waterfalls already exist in spreadsheets and trustee models. Encoding them as deterministic execution reduces operational breakpoints and makes trigger logic observable to stakeholders in real time.

Real-time reporting and investor transparency: When reporting becomes an always-on data layer rather than a monthly PDF, investors can underwrite faster, monitor more precisely, and price risk with less “model uncertainty premium”.

Faster settlement and cleaner collateral mobility: Tokenised tranches with atomic settlement reduce settlement risk and shorten funding cycles, particularly for short-duration assets like receivables.

Taken together, those mechanics can compress the all-in cost of issuance and widen the investor base.

That is exactly what Europe needs if it wants to recycle bank-originated risk into patient capital without expanding bank balance sheets indefinitely.

The Tranched Protocol: The Infrastructure Layer Securitisation Has Been Missing

Tranched’s thesis is that securitisation should operate like modern financial infrastructure: rules-based, data-driven, and enforceable at the workflow layer.

Practically, that means building rails that can:

ingest granular loan and receivables data into a standardised, auditable structure

automate eligibility, concentration limits, triggers, and reporting logic

produce investor-grade transparency without multiplying operational headcount

lower time-to-issue, especially for repeat issuers and warehouse-to-takeout pipelines

Europe’s agenda is to unlock financing capacity while maintaining prudential credibility.

The most credible path does not rely on looser standards. It relies on better instrumentation: cleaner data, tighter controls, and fewer manual failure points.

That is why securitisation is resurfacing at Davos: it sits at the intersection of competitiveness, financial stability, and capital mobilisation. And that is why on-chain rails are increasingly relevant: they make the securitisation machine cheaper to run, easier to audit, and faster to scale.