Regulation

Welcome to this week’s Tranched newsletter.

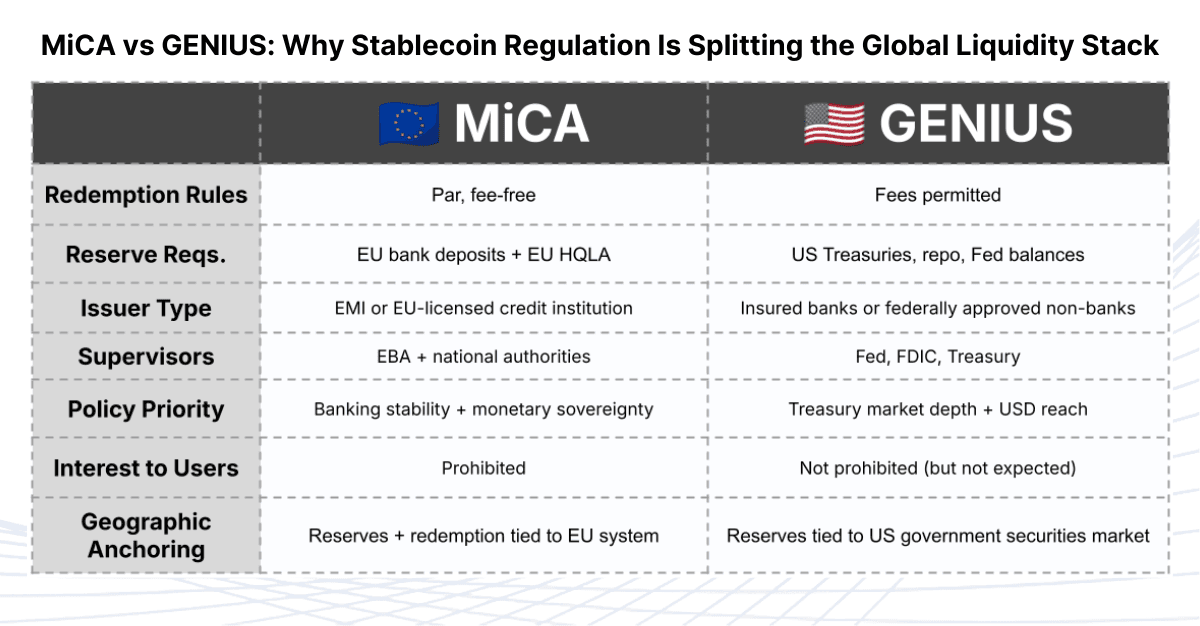

In this edition, we examine how MiCA and the GENIUS Act are reshaping the design and circulation of stablecoins. Their differing assumptions about reserves, supervision and monetary policy create structural breakpoints that now influence liquidity, issuance models and the future of on-chain credit.

Stablecoins are moving out of the experimental phase and into formal regulatory frameworks. Europe and the United States are now defining what “safe” digital money looks like, yet they are doing so from very different starting points. The result is a landscape where similar goals are translating into structurally incompatible rules.

This newsletter unpacks the differences, explains the consequences for issuers and liquidity, and outlines the wider implications for on chain markets.

The central claim is simple: MiCA and the GENIUS Act build stablecoins on top of different balance sheet assumptions, different supervisory priorities and different political incentives. These differences create real breakpoints for design, issuance and global circulation.

I. Two frameworks that aim for safety but follow different logics

Regulators in both regions want stablecoins to be fully backed, transparent and tightly supervised. The disagreement lies in what they believe stablecoins should be inside the financial system.

Europe’s view

The EU treats euro stablecoins as a close cousin of e-money, which places issuers inside the banking and payments perimeter. MiCA requires:

Redemption at par in the reference currency

Prohibition on paying interest to token holders

At least 30% of reserves held as deposits in EU credit institutions, with the remainder in high quality liquid assets

Issuers to be regulated as credit institutions or e money institutions

This framework aligns with Europe’s longstanding approach to monetary sovereignty and consumer protection. Policymakers are focused on safeguarding the banking system, supporting monetary transmission and ensuring that systemic euro tokens do not sit outside European supervision.

The United States

The GENIUS Act, signed in July 2025, takes a different approach. It defines payment stablecoins as instruments that should behave like narrow bank liabilities supported by short term government securities. It requires:

1 to 1 backing with cash and high quality liquid assets

Reserves concentrated in instruments such as T bills, reverse repo backed by Treasuries and Federal Reserve balances

Monthly public disclosures

Issuance limited to insured depository institutions and specially chartered non banks

This framework positions stablecoins closer to money market instruments. It strengthens demand for short dated US government securities and consolidates supervisory authority under federal banking agencies.

The philosophical divide becomes clear:

Europe builds around the banking system.

The United States builds around the Treasury market.

Both are rational choices within each jurisdiction’s economic model. These choices create incompatibilities for anyone attempting a unified global product.

II. The breakpoints: where the frameworks cannot be reconciled

Three pressure points matter most for issuers:

1. Redemption mechanics and incentives

MiCA requires fee free redemption in most circumstances. GENIUS does not include that requirement and US lawyers widely interpret redemption fees as a valid tool for liquidity and risk management.

The issue is not the existence of fees in isolation. It is the incentive pattern they create. If a token is simultaneously circulating in Europe and the United States, and if redemption is free in one region and potentially fee based in the other, redemption volumes will naturally concentrate in the lower cost jurisdiction during periods of stress.

This scenario places disproportionate pressure on the issuer’s European balance sheet and, by extension, on the EU credit institutions holding mandated reserve deposits. The risk is mechanical rather than theoretical. It is a difference in economic design that produces different flows under stress.

2. Reserve composition

MiCA requires a significant share of reserves to sit in EU bank deposits. GENIUS encourages reserves to sit almost entirely in US Treasuries and repo markets. These requirements reflect the strategic priorities of each region. Europe prioritises bank stability and local supervision. The United States prioritises Treasury market depth and liquidity.

A global stablecoin cannot satisfy both models with the same reserve portfolio. A portfolio optimised for MiCA fails GENIUS requirements. A portfolio optimised for GENIUS fails MiCA’s deposit rules. This conflict sits at the centre of the design problem.

3. Supervisory and political design

MiCA is administered by the European Banking Authority and national competent authorities. GENIUS introduces a joint role for the Federal Reserve, FDIC and Treasury.

The political incentives differ. European regulators consistently message that euro stablecoins must remain within the EU financial system. US policymakers consistently link stablecoin growth with strengthening the US dollar’s global role.

This creates different expectations for issuer location, reserve custody and regulatory reporting. These choices are not easily harmonised because they reflect competing policy objectives rather than technical disagreements.

III. The issuer’s dilemma: why a single global token no longer works

Once these breakpoints are added together, issuers face a practical design constraint.

A single token with a single reserve pool cannot comply with both MiCA and GENIUS. Issuers therefore confront three options:

1. Prioritise one region’s framework - This is the simplest path but sacrifices access to the other market. Several issuers have already withdrawn or scaled back European offerings while they reassess MiCA obligations.

2. Operate two legally distinct tokens - This is the direction signalled by issuers who want presence in both jurisdictions. It requires dual reserve pools, dual compliance processes and dual redemption mechanics. Liquidity becomes regional rather than global.

3. Maintain a single brand with separate underlying instruments - This approach keeps consumer facing continuity but splits the regulatory infrastructure underneath. It mirrors how global banks issue region specific money market funds that share a name but do not share assets.

Even large issuers will feel the strain. A combined US and EU strategy now requires: parallel licensing, distinct reserve strategies, separate risk disclosures, jurisdiction specific redemption mechanics and region specific supervision.

IV. How Divergent Rules Reshape the Market: Liquidity, Instruments and Credit Infrastructure

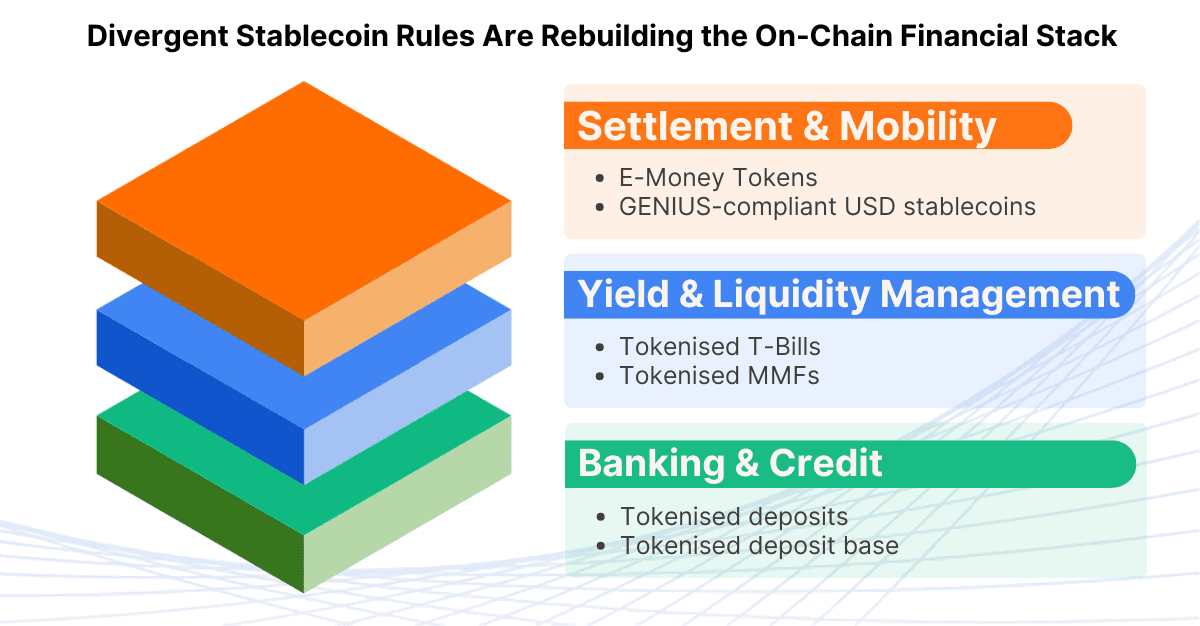

The regulatory divergence between MiCA and GENIUS does not stop at the issuer level. It cascades into the structure of on chain liquidity, the instruments that gain market share and the way credit infrastructure must operate.

The market is already adjusting to the constraints created by incompatible reserve models, different redemption mechanics and different supervisory expectations. The result is a gradual shift toward a more layered and heterogeneous money environment.

1. Liquidity patterns begin to regionalise

MiCA requires that E-Money Tokens reserves be anchored to EU credit institutions and that redemption rights be exercised in fiat through EU supervised entities. GENIUS encourages USD stablecoins to hold reserves primarily in short term Treasury instruments, with supervision concentrated under federal banking agencies. These design choices create different liquidity homes for the same functional product.

Market data already shows liquidity clustering around the regulatory perimeter. By mid-2025, tokenised U.S. Treasury products exceeded $7.3B in assets on public blockchains, with institutional tokenised funds such as BlackRock’s BUIDL and Franklin Templeton’s FOBXX contributing materially to growth.

At the same time, euro stablecoin circulation remains roughly $300M despite MiCA clarity, compared to more than $160B dollars in USD stablecoins.

These figures reflect different reserve environments and use cases. The US environment is increasingly linked to the Treasury market. The EU environment is increasingly tied to the banking system. Liquidity becomes anchored to jurisdiction specific reserve pools, which makes conversion between them feel closer to cross border settlement than a single universal digital dollar.

2. Yield bearing instruments expand as unremunerated stablecoins mature

MiCA and GENIUS define stablecoins as payment instruments, not yield-bearing assets. Both frameworks prevent issuers from passing on income earned on reserves. This design keeps stablecoins close to cash rather than credit. The result is a predictable market response.

Investors who need yield migrate to tokenised Treasury funds, which have grown significantly over the past two years. BlackRock’s BUIDL passed $500M dollars within months of launch and Franklin Templeton’s BENJI token surpassed $370M dollars in 2024.

These instruments offer the liquidity and transparency expected in digital markets while providing a risk profile similar to traditional money market funds. They have become the natural home for on chain cash that seeks a return.

This shift does not reduce the relevance of stablecoins for settlement and mobility. It creates a layered environment where:

stablecoins handle payments, transfers and programmability

tokenised T bills provide the yield-bearing store of value

both coexist within the same on chain liquidity stack

The dynamic is a direct result of regulatory design. When stablecoins are restricted from offering yield, alternative instruments rise to fill the gap.

3. Banks explore tokenised deposits to retain influence over digital money

European banks are beginning to issue tokenised deposits that stay within the existing banking framework, carry deposit insurance and pass on interest. This development fits naturally within MiCA’s design philosophy, which anchors digital money to supervised institutions and reinforces the role of banks in payment infrastructures. The ECB has noted that tokenised deposits could complement other regulated digital money instruments and support efficiency gains in settlement.

These instruments emerge for a simple reason. MiCA defines E-Money Tokens as non-interest bearing and fully backed by segregated reserves, while banks need instruments that continue to support credit creation and customer yield. Tokenised deposits allow banks to operate within MiCA’s boundaries while preserving their economic role.

This does not challenge the role of stablecoins. It reflects the influence of regulatory design on market structure. When MiCA limits what E-Money Tokens can do, banks meet the remaining demand with tokenised deposits. When GENIUS limits stablecoins to payment activities, investors meet their yield needs with tokenised Treasury funds. Each instrument fills the space that regulation leaves open.

Therefore, on-chain markets evolve toward a menu of settlement assets rather than a single dominant form.Market participants will use tokenised deposits, E-Money Tokens, GENIUS regulated USD tokens and tokenised money market funds depending on whether they need credit, yield, mobility or programmability.

For builders and liquidity providers, this means operating across E-Money Tokens, GENIUS compliant USD tokens, tokenised deposits and tokenised funds rather than assuming one universal settlement asset.

V. A Fragmented Settlement Layer = An Opening for Better Regulation

MiCA and GENIUS bring stablecoins into formal supervision, but both frameworks treat them primarily as payment instruments. The market has moved in a different direction. Stablecoins now operate across liquidity management, collateral flows and institutional settlement, which places them closer to market infrastructure than consumer payments.

MiCA’s e-money perimeter reflects yesterday’s use case. GENIUS aligns stablecoins more closely with US money markets, yet it still leaves important questions about how these instruments function in broader capital-markets activity. Neither framework fully captures the role stablecoins now play in institutional finance.

This creates a strategic opportunity for Europe. With PSD3 and the next regulatory review cycle approaching later this decade, the EU can reposition stablecoin policy around market functionality rather than payments. A regime built for settlement, liquidity and institutional use cases would not only address current limitations but position Europe as the jurisdiction offering the most coherent and forward-looking framework.

The settlement layer is fragmenting, and credit infrastructure will adapt. The advantage lies with the region that recognises stablecoins as part of the market architecture itself. Europe still has the space to design that regulation.