Knowledge

Welcome to this week’s Tranched newsletter.

In this edition, we look beyond the narrative of tokenisation as simply faster or always-on markets and focus on where the real institutional value is emerging.

While extended trading hours matter, the deeper shift is happening at the level of credit, enforceability, collateral control, and programmable cash flows, reshaping how financial institutions scale capital across payments and private credit.

Tokenisation is often introduced through the lens of speed.

Faster settlement cycles, extended trading hours, and markets that operate continuously.

These are real improvements. They reduce friction, widen access, and modernise market operations. But they are not the primary reason large financial institutions are investing serious capital, engineering effort, and regulatory bandwidth into on-chain infrastructure.

The deeper value unlock lies in how assets support credit: how ownership is proven, how collateral is controlled, how cash flows are enforced, and how risk is managed once assets move beyond a single balance sheet.

Trading efficiency matters. Credit enforceability changes the system.

Trading efficiency is additive. Credit efficiency is structural.

Extended trading windows improve responsiveness and global accessibility. For liquid assets, they can enhance price discovery and reduce timezone frictions.

Credit, however, is what determines scale.

Most institutional financial activity is driven not by spot transactions, but by funding structures: warehouse lines, securitisations, margin facilities, and balance-sheet leverage.

In those contexts, the core questions are not when an asset can trade, but whether it can be:

reliably pledged as collateral,

monitored continuously against contractual terms, and

enforced predictably if performance deteriorates.

This is why some of the most advanced on-chain initiatives are emerging not in trading venues, but in payments, settlement, and private credit infrastructure.

For example, Visa has publicly framed stablecoin settlement as a way to improve funding and payout mechanics rather than to enable speculative activity, while J.P. Morgan has used its Onyx platform and JPM Coin to optimise wholesale settlement and collateral mobility between institutional counterparties.

The emphasis is consistent: reduce uncertainty in credit and settlement chains first; liquidity follows.

From representation to control: why lien perfection matters

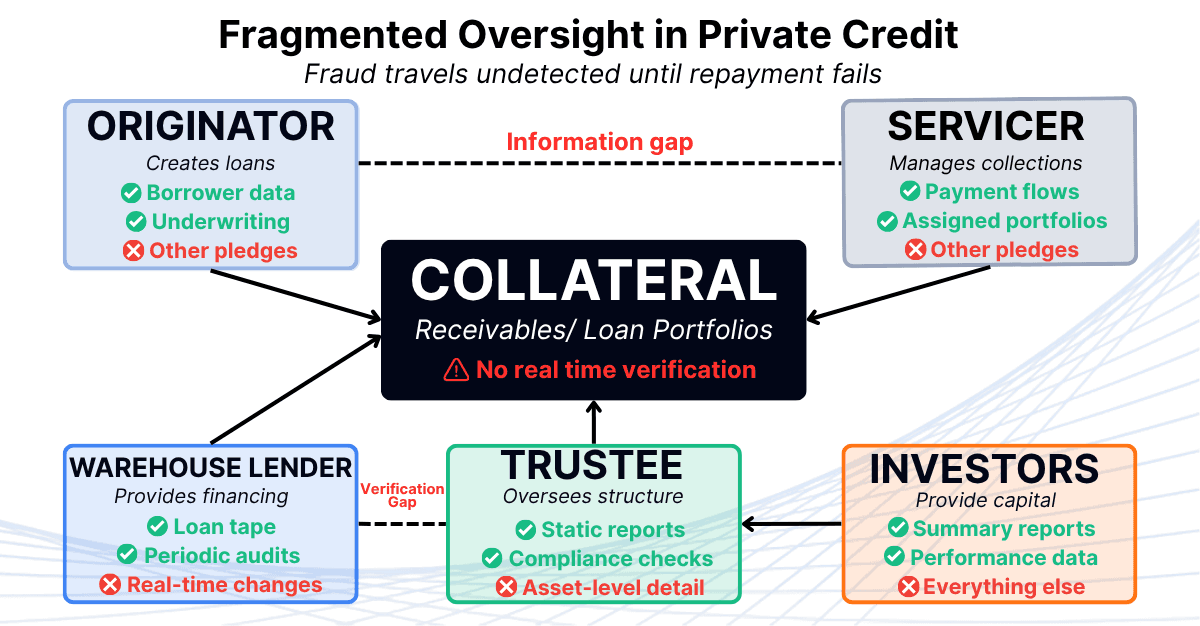

Traditional finance enforces credit through layered custody, legal agreements, trustees, servicers, and periodic reporting. This framework is robust in theory, but its weaknesses surface under stress.

Recent private credit failures underline the point. In cases such as First Brands Group and Tri Color Auto, investors faced delayed visibility into collateral quality, cash-flow leakage, and limited real-time control over enforcement. By the time problems were fully recognised, losses were already embedded.

(We did an entire analysis on the issue. Read it here)

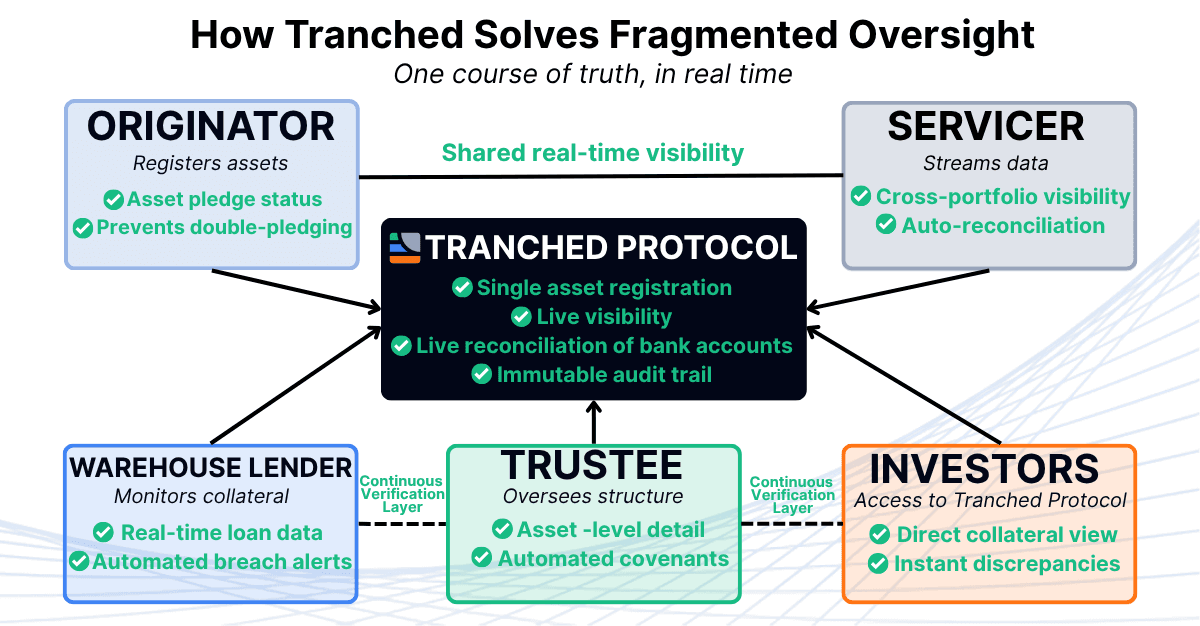

Tokenisation responds to this failure mode when it is designed around control rather than representation.

We can already see this shift in practice:

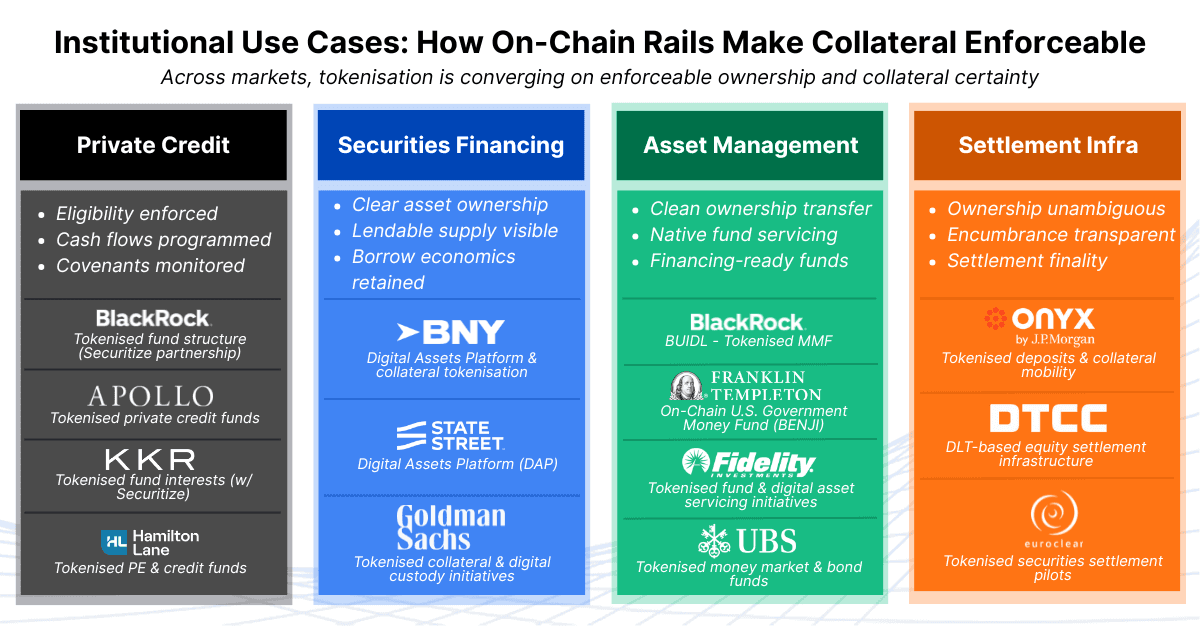

In private credit and structured finance, platforms are moving towards on-chain representations of receivables and loan pools that encode eligibility criteria, advance rates, and waterfall logic directly into operational flows. This mirrors how firms like BlackRock have approached tokenised funds, where ownership transfer, servicing, and reporting are treated as core infrastructure rather than distribution features.

In securities financing, clearer control over asset availability and lending terms allows asset owners to retain more of the economics of stock borrow, rather than relying entirely on prime brokers to intermediate enforcement.

In asset management, products such as Franklin Templeton’s tokenised money market fund and BlackRock’s BUIDL initiative are designed to support cleaner ownership transfer, improved servicing, and better integration with financing workflows. These funds are built to be used as financial building blocks.

In settlement infrastructure, initiatives such as The Depository Trust & Clearing Corporation (DTCC)’s Project Ion and J.P. Morgan’s collateral mobility experiments focus on reducing ambiguity around ownership and encumbrance.

Across these examples, the value comes from improving lien perfection: making claims on collateral clearer, harder to duplicate, and operationally enforceable with fewer manual breakpoints.

Conclusion: enforceable credit first, marketplaces second

Tokenisation’s first chapter focused on access and efficiency. Its second chapter is about structure.

As credit migrates on-chain, institutions are converging on a clear priority: assets must be enforceable by design. That means strong collateral rights, programmable cash-flow control, and operational processes that function under stress, not just in steady state.

Once that foundation is established, the next phase becomes possible. The sequence is already emerging:

Tokenise the asset to remove time, cost, and ambiguity.

Scale credit on top of it through enforceable, programmable structures.

Build marketplaces once collateral certainty and liquidity are proven.

This is precisely the layer Tranched is building: on-chain credit rails where enforceability, cash-flow control, and capital efficiency are native features rather than afterthoughts.

Throughout this evolution, the motivation remains consistent. The real transformation is not about trading faster. It is about building a financial system where credit is clearer, safer, and more scalable by construction. That is the layer where tokenisation stops being experimental and becomes infrastructure.