Finance

Welcome to this week’s Tranched newsletter.

This week, we look at what happens when a market built for constant motion is suddenly forced to absorb shock. The October 10 liquidation revealed how code, collateral, and connectivity shape outcomes when volatility turns systemic. In this edition, we analyse that episode as a live experiment in financial architecture and risk management.

On Friday, October 10th, the digital-asset market underwent one of its most significant real-time stress tests to date. A global macro announcement triggered more than $19B in forced liquidations across crypto futures and perpetual markets within hours.

The episode exposed how leverage, liquidity, and risk management interact under strain. It also highlighted the players and systems that remained stable while others faltered. This edition examines that stress test in detail: how risk cascaded through the system, which institutions and protocols withstood it, and what the episode tells us about the evolving resilience of on-chain finance.

The trigger

The sequence began with a policy shock. Donald Trump announced a 100% on Chinese imports, reviving trade-war concerns and reshaping risk sentiment across markets.

Traditional assets paused for the weekend, but crypto trades continuously. Prices began adjusting immediately. Bitcoin fell from roughly $122K to below $110K in a few hours. Ethereum and other major tokens followed. Open interest across futures markets collapsed as automated liquidations swept through positions that could no longer meet margin requirements.

CoinShares described the event as “a cascade caused by excessive leverage and cross-collateralisation, where automated margin calls amplified price declines.”

Liquidity providers reduced risk exposure and temporarily withdrew orders from exchanges, which made order books thinner and accelerated price movement.

A live stress test

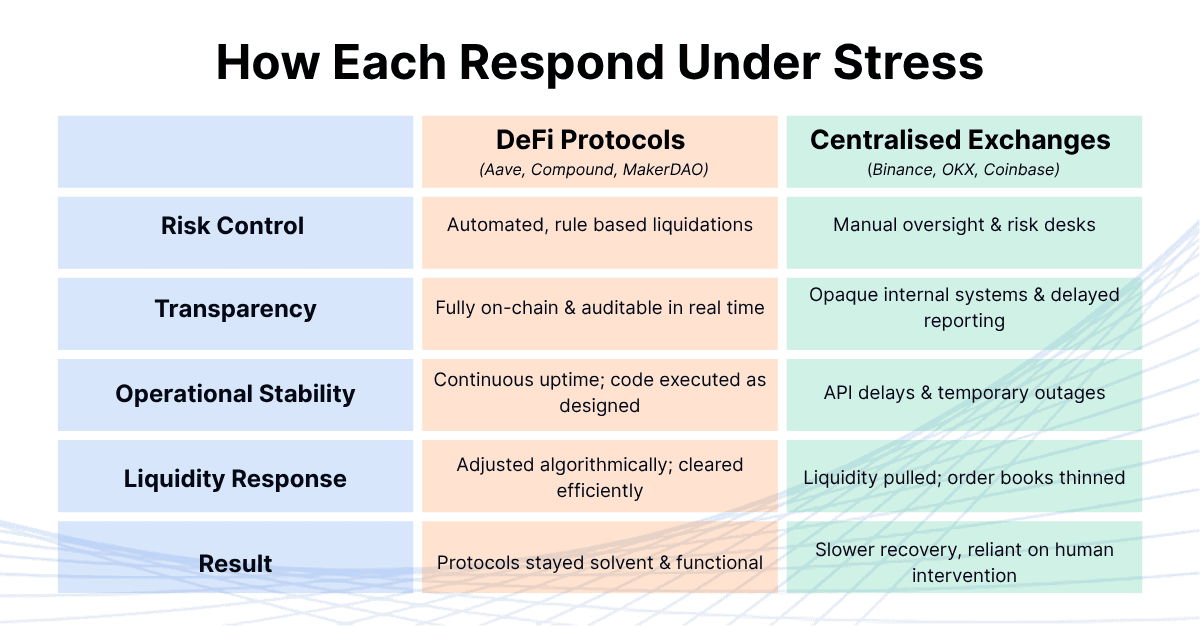

The market reaction unfolded entirely within the digital ecosystem. With no trading halts or central liquidity backstops, the sell-off became a natural experiment in how decentralised finance infrastructure behaves under pressure.

DeFi protocols such as Aave, Compound, and MakerDAO operated as intended. Their collateral mechanisms liquidated under-secured loans automatically, maintaining solvency.

Centralised exchanges experienced greater operational strain. Several reported API delays and partial outages as transaction volumes spiked.

The result was a clear contrast between algorithmic risk controls embedded in smart contracts and human-operated systems that depend on manual oversight. The protocols continued to function within their coded parameters. The exchanges had to adjust in real time.

Structural weaknesses

Analysts reviewing the episode later identified three main weaknesses in market design.

1) Leverage concentration:

In crypto, many traders use leverage, which means borrowing money (often stablecoins) to take larger positions than their actual capital allows. For example, with 10x leverage, someone with $10K can hold $100K worth of Bitcoin.

Normally, if the market moves slightly against you, the exchange asks for more margin (extra collateral). If you can’t add it, your position is liquidated (automatically sold to repay the debt).

The issue here was cross-venue collateral reuse, often called rehypothecation in traditional finance. Traders were pledging the same Bitcoin (or USDC) as collateral on several exchanges at once. Many exchanges allow “cross-margining,” where all your positions share the same pool of collateral instead of being isolated per trade.

So when prices started falling:

The same Bitcoin that backed multiple leveraged positions lost value everywhere at once.

Because it was being reused, there wasn’t enough cushion to cover losses in all those positions simultaneously.

As a result, it became clear that the entire system was overexposed to the same collateral base. There was an “illusion of depth” where it looked like there was lots of liquidity and collateral, but much of it was synthetic or duplicated.

2) Absence of trading halts:

In traditional stock markets (like the NYSE or London Stock Exchange), there are circuit breakers that automatically pause trading if prices move too sharply in a short time. For example, if the S&P 500 falls 7%, trading is halted for 15 minutes. This gives participants time to reassess, prevents panic, and allows liquidity providers to reset orders.

Crypto markets do not have this feature. They operate 24/7, globally, across hundreds of venues, with no unified oversight.

Thus, during the October 10 crash, as prices started falling quickly, there was no mechanism to slow the cascade.Liquidation engines kept selling positions into thinner and thinner markets, and falling prices triggered further liquidations in a self-reinforcing loop until excess leverage was flushed from the system.

The absence of pauses allowed the event to escalate far faster than it would in a regulated market. Traders and exchanges simply could not keep up with the pace of forced selling.

3) Price fragmentation:

Unlike equities (where there’s one official market price), crypto assets trade on hundreds of exchanges, each with its own order book and internal pricing algorithm. Some platforms (like Binance or OKX) maintain an “internal mark price” to determine when to liquidate leveraged positions. This mark price is supposed to reflect the average market price, but during volatile periods, it can deviate significantly.

During the liquidation:

Some exchanges’ internal prices fell below the global market average.

This meant positions were forcibly liquidated earlier and at worse prices than they should have been.

Because liquidity was fragmented, arbitrageurs (who normally buy cheap on one exchange and sell high on another) could not respond fast enough to close these gaps.

As a result, different venues showed different prices for the same asset, and these discrepancies deepened the losses. It also prevented the market from “self-correcting” through arbitrage, which would normally stabilise prices.

The counterparties that held firm

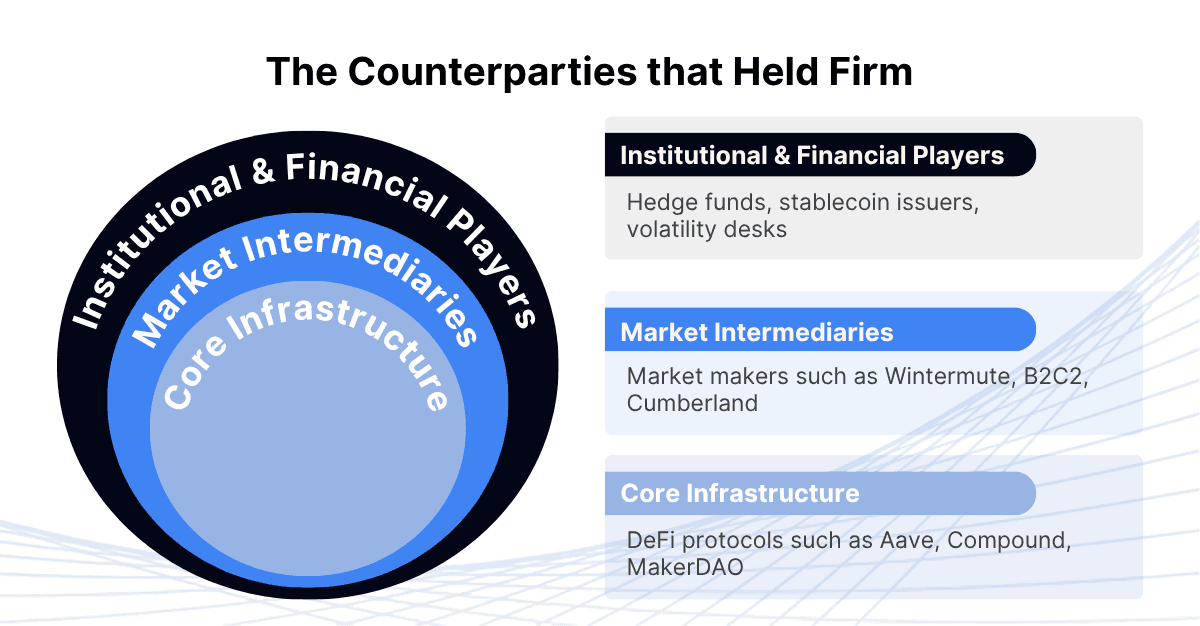

Despite widespread losses, several categories of participants demonstrated resilience. Their experience offers practical insights for risk management in digital-asset markets.

1. Market-neutral hedge funds

Funds that maintained delta-neutral positioning and strict exposure limits weathered the episode with limited impact.

Financial News London reported that some quant funds ended the weekend flat after models automatically reduced leverage as funding rates climbed. Their performance reflected disciplined execution rather than prediction: exposure limits and automated hedging worked as designed.

2. Decentralised money markets

Aave, Compound, and MakerDAO’s mechanisms functioned as designed. Liquidations occurred transparently, and collateral ratios were maintained. DAI and other over-collateralised stablecoins held their pegs. These outcomes reinforced a principle already discussed in regulatory literature: transparency supports solvency.

3. Professional market makers

Liquidity providers with diversified connectivity across venues such as Wintermute , B2C2, and Cumberlandmaintained operations by diversifying liquidity across exchanges and OTC venues. When depth declined on one platform, they rerouted orders or hedged on CME futures. Diversification of trading infrastructure limited exposure to single-venue outages.

4. Stablecoin issuers with full collateralisation

Fully backed stablecoins such as USDC and USDT maintained price stability throughout the volatility. Real-time reserve attestations and conservative portfolio management reassured markets. Algorithmic or yield-enhanced alternatives saw brief deviations, reinforcing the importance of transparent collateral management.

5. Volatility traders and option desks

Specialist desks holding long-volatility positions benefited as implied volatility doubled during the event. Their returns were the outcome of standard hedging discipline rather than opportunistic speculation. Paying for downside protection in calm periods provided liquidity when it was most needed.

Aftermath and adjustment

By Sunday evening, markets began to stabilise. Bitcoin recovered to around $110K, and funding rates on perpetual contracts turned negative.

The excessive leverage had been flushed from the system. Institutional venues such as CME saw record trading volumes the following week as investors sought exposure in more regulated environments.

Analysts noted that while losses were significant, the containment of the event within the crypto ecosystem was itself a sign of progress. There was no spillover into banking or payments infrastructure. The system had bent, but not broken.

How On-Chain Architecture Alters Systemic Risk

In a way, the liquidation showed that digital markets now mirror traditional finance in both structure and vulnerability. Leverage, collateral reuse, and liquidity dependence make crypto markets behave like a leveraged financial system rather than a separate asset class. The patterns of October 10, leverage build-up, liquidity withdrawal, and feedback loops, are identical to those seen in traditional stress events such as the 2008 crisis or the 2020 “dash for cash.”

Yet the fact that these dynamics played out on-chain changes the nature of the outcome.

Transparency replaced opacity: market participants could see liquidations, collateral ratios, and flows in real time. Automated smart contracts enforced margin calls instantly, preventing hidden losses and reducing counterparty uncertainty. There were no maturity mismatches or delayed margin settlements, and the system reset within days without external intervention.

In traditional markets, such a shock would have required weeks of coordination and central-bank liquidity to contain. In DeFi, it cleared automatically because risk management is encoded in the infrastructure itself.

This distinction is what makes on-chain finance structurally different from pre-crisis banking. Crises still occur, but they unfold in the open and conclude without paralysing the system. That transparency creates a new type of resilience: one based on real-time observability rather than after-the-fact reconstruction.

Conclusion

The October 10 liquidation was not merely a market correction. It was a full-scale demonstration of how crypto markets absorb macroeconomic shocks without external support.

The episode exposed fragilities, but it also revealed emerging maturity in how risk is distributed and managed. Participants who built systems grounded in transparency, automation, and conservative leverage endured the volatility and, in some cases, gained from it. Their performance suggests that resilience in digital finance depends less on predicting market direction and more on designing frameworks that function predictably when uncertainty rises.

In that sense, the events of October 10 served as a proof of concept: the infrastructure of on-chain finance is still evolving, but it is learning to withstand real stress.