Knowledge

Welcome to this week’s Tranched newsletter.

In this week’s edition, we examine KlarnaUSD and what its launch reveals about the architecture of modern payments. The shift tells us how large platforms respond when legacy settlement rails no longer fit the scale of their operations.

Every day, global platforms push payments through a maze of old infrastructure: legacy banks, settlement windows, multi-ledger reconciliations and FX corridors that behave differently in every region. The system functions, although the accumulated friction is enormous. A growing number of fintechs have started to design their own rails to create a cleaner path for moving value.

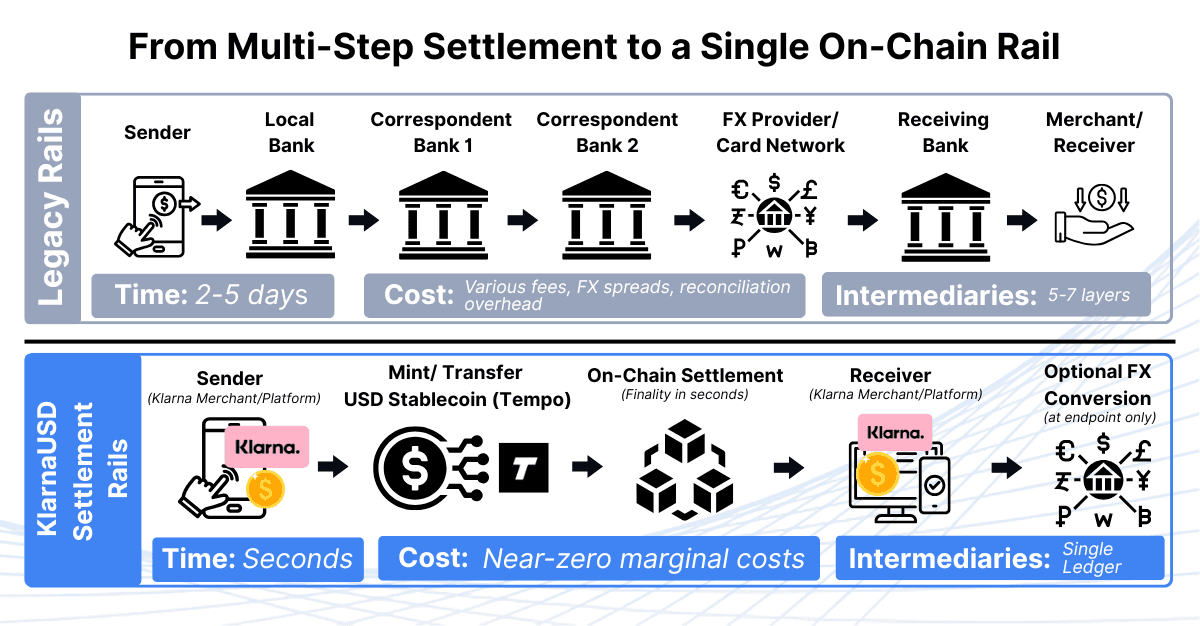

KlarnaUSD is one of the most visible examples so far. Klarna introduced a dollar-linked stablecoin running on Tempo, giving the company a direct settlement layer shaped for high-velocity transactions. Merchant transfers, refunds and cross-border flows now move through a single, programmable structure. The decision brings industrial-grade settlement capabilities into a mainstream consumer platform, a development that expands the boundaries of what global payment networks can become.

The next sections unpack the mechanics behind this shift: the pain points inside today’s cross-border payment system, the economics of Tempo, and the impact of real-time, tokenised settlement. The underlying thesis: the architecture of payments is changing, and KlarnaUSD is one of the first signals of what that new structure will look like.

Why KlarnaUSD Matters for a Platform of This Size

Klarna occupies a central position in global online commerce. The company serves more than 150M users, works with 500,000 merchants, and processes transaction volume that reaches across Europe, the US and more.

Its role extends far beyond checkout; Klarna handles refunds, split-payments, cross-border merchant settlement and recurring disbursements across a complex web of corridors. A payment change inside a platform of this size influences activity across thousands of merchants and millions of end-users.

The launch of KlarnaUSD introduces a settlement format that matches this scale. A dollar-denominated token running on a high-throughput network gives Klarna a way to route value through a single, programmable structure rather than the patchwork of domestic systems it has relied on for a decade.

The move signifies more than an experiment. It marks the moment when one of the world’s largest consumer-fintech networks begins shifting core settlement functions onto infrastructure built for continuous global movement. For the wider industry, this signals a direction-of-travel: payment scale is reaching a point where constructing proprietary settlement rails becomes not only viable, but strategically necessary.

The underlying pain points in global payments

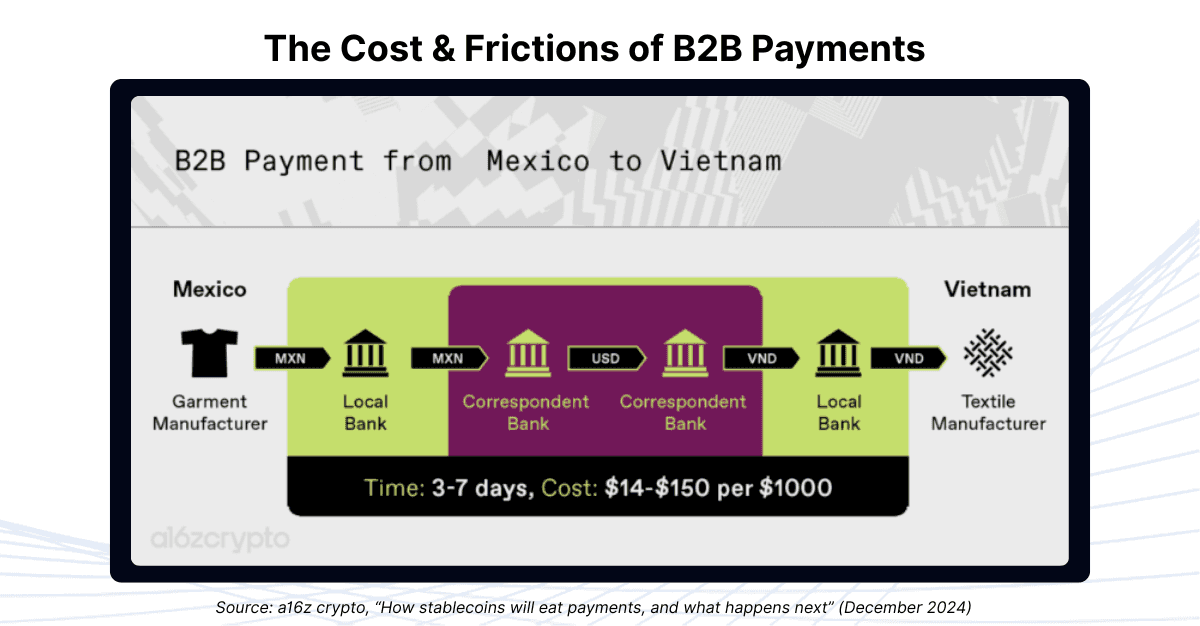

The global payments landscape still depends on a long chain of intermediaries. Every step introduces fees and administrative work. Cross-border payments illustrate the scale of this burden. According to McKinsey’s 2023 Global Payments Report, cross-border fees account for roughly $120B of annual industry revenue, out of a total pool of about $250B. Much of this revenue comes from structural friction: correspondent banks, FX mark-ups, card network fees and multi-ledger reconciliation.

Settlement timelines vary widely. The Bank for International Settlements notes that international bank transfers can take 2 to 5 days, depending on route and jurisdiction. Card settlement adds its own schedule, with proceeds often delivered to merchants on T+2 or T+3. These delays require platforms to hold liquidity buffers and run treasury operations that compensate for varying release times. High-volume payment networks face persistent float across markets.

FX activity creates another layer of cost. The World Bank calculates that remittance and cross-border e-commerce corridors regularly involve 2–8% in total charges when combining spreads, processing fees and intermediary costs. Even when fees fall below this range in developed markets, the spread still shapes margins across millions of transactions.

Klarna operates across more than 20 countries, each with its own settlement logic. Maintaining this patchwork produces operational overhead: reconciliation between systems, timing mismatches between banks, compliance checks across local regimes and diverse merchant contract structures. These activities form a hidden cost base inside the platform’s global footprint.

How KlarnaUSD changes the cost structure

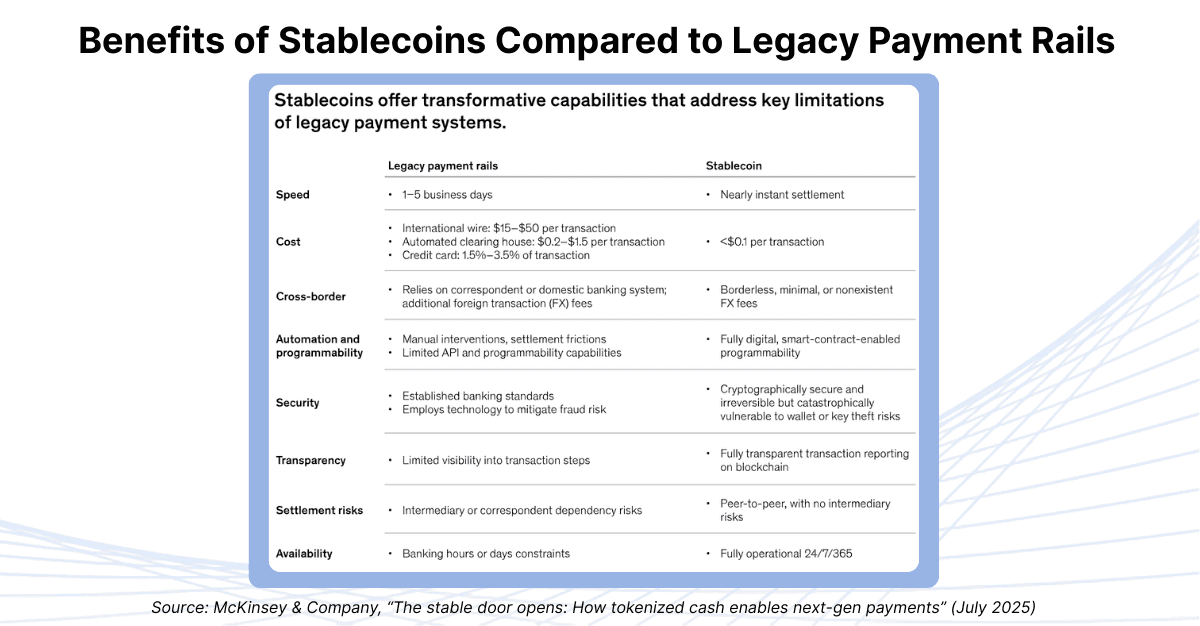

A stablecoin provides a single network for settlement. Transfers complete on-chain, and the ledger records the entire sequence of movements. This design reduces the number of intermediaries involved in each step. With fewer institutions touching the transaction, the fee structure becomes lighter.

With its near-zero marginal cost per transfer, Tempo, the independent blockchain started by Stripe and Paradigm, reinforces these gains. The payments-focused Layer-1 is designed to move stablecoins with high throughput and instant finality. Tempo’s network supports EVM-compatible smart contracts, so payment logic can run on-chain without redesigning existing systems. Transactions settle in seconds and fees are paid directly in stablecoin, removing volatility and simplifying treasury operations. Tempo also includes payment-native functions such as batch transfers, embedded metadata and compliance-ready controls that mirror features of traditional payment schemes. These elements create a rail optimised for high-volume corporate flows, giving Klarna a settlement layer shaped for continuous global activity.

Building on the Tempo foundation, real-time settlement reshapes liquidity management. Funds no longer sit in transit, and treasury teams gain predictable access to incoming cash. BIS analysis indicates that faster settlement can release 10–30 basis points of liquidity tied up in multi-day cycles. For Klarna, this reduces the capital held idle to bridge timing gaps across markets.

A dollar-denominated token simplifies the path further. Transfers move through a single currency format until the final conversion point, which reduces reliance on intermediary banks and limits the accumulation of FX spreads across a chain of correspondent institutions. BIS analysis shows that the global network of correspondent-banking relationships declined by roughly 22% between 2011 and 2018, and cross-border corridors have continued to contract, increasing concentration among a smaller set of banks. As a result, Klarna faces fewer FX touchpoints and avoids the cost layers associated with multi-step correspondent routing by using stablecoin rails.

Alongside the FX and routing benefits, the structure of the ledger itself produces additional efficiencies. The unified ledger then changes reconciliation. Each movement is final at settlement, so operational teams work with far fewer exceptions. Compliance checks integrate directly into the ledger logic, and audits follow a single record of activity rather than multiple domestic platforms. The administrative load becomes lighter across each transfer cycle, reducing the overhead that once accompanied Klarna’s global footprint.

These elements work together to reshape the cost base of a high-volume payment platform. The shift is not limited to faster movement of money; it reorganises the processes that surround every transfer. For a global payments giant like Klarna, this places a modern settlement rail at the centre of its payment stack and transforms infrastructure optimisation into measurable financial impact.

The broader industry direction: Stablecoins Are Becoming Settlement Infrastructure for Global Platforms

KlarnaUSD reflects a growing interest in programmable settlement across global platforms. Fintechs that operate at scale are examining tools that simplify the movement of funds across regions. The interest is driven by the need for predictable settlement behaviour, real-time processing and a ledger structure that supports automation at scale..

Other companies are exploring similar approaches. PayPal introduced PYUSD for internal settlement experimentation.Grab in Southeast Asia has tested tokenised value for ride-hailing and merchant payouts. Line Corporation in Japan launched a JPY stablecoin linked to its broader fintech ecosystem. These projects form a set of signals pointing toward renewed attention on the infrastructure beneath consumer-facing applications.

Across these examples, the pattern is consistent: high-volume platforms are beginning to anchor their payment operations on programmable settlement layers, signalling a structural shift in how global networks move money.

Considerations that shape adoption

Adoption depends on participation across merchants, platforms and conversion partners. The benefits grow as more activity moves end-to-end on a single rail, and liquidity depth in the surrounding ramps becomes part of the overall system design. Some users still prefer settlement in bank money, which makes conversion infrastructure an important part of the journey. These factors influence how quickly a network like KlarnaUSD can reach the scale where its efficiencies compound.

Regulation also defines the environment in which stablecoins operate. MiCA in the European Union sets detailed requirements for reserves, governance and reporting, and several jurisdictions (including Singapore, the UK and Japan) have incorporated tokenised payment instruments into their licensing regimes. The United States continues to shape its own framework through ongoing legislative proposals. These regulatory contours determine how stablecoin systems are structured and the roles they can play inside large platforms.

Consumer experience guides much of the remaining adoption path. Payment flows involve merchants, shoppers and partners with varying expectations about speed and interface design, and many prefer systems that keep the underlying asset abstracted away. Settlement layers that integrate into familiar workflows are more likely to gain traction. This aspect determines whether stablecoin rails become a visible feature or simply part of the background infrastructure.

Taken together, these considerations shape the pace at which stablecoin settlement becomes embedded in mainstream networks. They influence not only how quickly platforms adopt these rails but also how effectively the underlying efficiencies can transform the economics of global payments.

Closing thoughts

KlarnaUSD is an early example of what happens when global platforms internalise their settlement logic. The change rewrites more than a payment flow; it rewires the incentives that determine where liquidity sits, how costs accumulate and who controls the rails. Once these choices start compounding inside large networks, the structure of the payment industry shifts with them.