DeFi

Welcome to this week’s Tranched newsletter.

In this week’s edition, we unpack how prediction markets are transforming from betting platforms into data engines, and why blockchain is the infrastructure everything converges on.

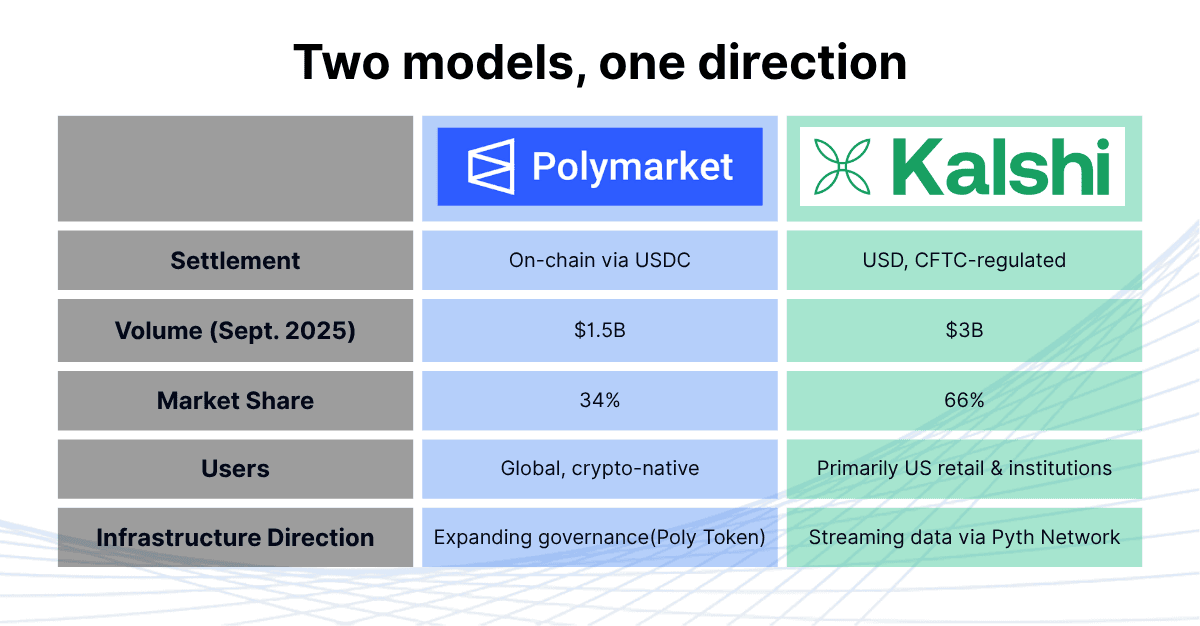

Prediction markets have entered their breakout moment. September marked the industry’s busiest month since the 2024 U.S. election: Polymarket processed roughly $1.5B in trades, while Kalshi cleared just over $3B, pushing combined weekly activity to $1.45B, second only to the election week record of $1.98B.

The surge signals the start of a convergence. Centralised, regulated exchanges and decentralised protocols are both being pulled toward the same foundation: blockchain infrastructure.

For years, prediction markets struggled to expand beyond isolated platforms; their data was fragmented, settlement opaque, and integration with the wider financial system limited. Blockchain changes that equation. It provides the open standards, transparent resolution, and composable data layers that allow these markets to scale globally and connect with other parts of finance and AI.

This shift is already visible. Wall Street is writing billion-dollar cheques, regulators are formalising oversight, and for the first time, regulated event data is streaming on-chain. The future of prediction markets isn’t just being built beside blockchain. It’s being built on top of it.

Two strategies, one destination

Polymarket and Kalshi dominate the space, but from opposite directions.

Polymarket is the crypto-native pioneer. Built on Polygon Labs and settled in USDC, it allows anyone to trade outcome tokens on everything from AI model releases to election results. September was its strongest month on record, and a $2B investment from Intercontinental Exchange (ICE) (parent of the NYSE) valued the company at $9B. That backing validated the model: when trades, outcomes, and liquidity are verifiable on-chain, crowdsourced foresight becomes a bankable asset class.

Kalshi took the opposite path. Licensed by the U.S. Commodity Futures Trading Commission, it operates as a regulated event-contract exchange where users trade in dollars through partners like Robinhood and FOREX.com. Its compliance edge has pushed its market share from 3% last year to roughly 66% today.

Despite Kalshi’s larger trading volumes and dominant US market share, its latest funding round placed its valuation at around $5B, nearly half of Polymarket’s $9B. The gap reflects how investors are pricing long-term potential rather than short-term revenue. Kalshi’s regulated framework offers stability but limits its speed of innovation, while Polymarket’s crypto-native model scales globally and integrates directly with blockchain infrastructure. As a result, even Kalshi, the archetype of a traditional platform, is now scrambling to build on blockchain.

Turning predictions into data

Kalshi ’s recent partnership with Pyth Network, an institutional-grade oracle provider, marked a watershed. Pyth will distribute Kalshi’s regulated event prices, covering everything from the New York City mayoral race to the number of Federal Reserve rate cuts in 2025, across 100 + blockchains. It is the first time that regulated event data will be broadcast publicly at scale.

The move reframes what prediction markets produce. Instead of siloed contracts, each market now emits a continuous data stream: the crowd-implied probability of a future outcome. Developers can plug that stream into DeFi protocols, analytics dashboards, or AI agents that learn from real-time expectations. Kalshi’s order book becomes a public oracle for what the world believes might happen next.

"Oracles represent the first step in taking Kalshi onchain. Now builders can finally bring their Kalshi ideas to life on the world computer." — John Wang

Meanwhile, Polymarket continues to lead on open access and on-chain transparency. Every trade settles automatically, every outcome is resolved by oracle attestations, and the data is visible on-chain.

Together, these two approaches are building the same thing from opposite ends: a global layer of priced expectations that other systems can consume.

Data as a financial product

The industry’s next phase is where data itself becomes the tradable good. Every market outcome produces an information asset that can be packaged, indexed, and sold.

Policy forecasting: When official indicators are delayed (as during the recent U.S. government shutdown) markets like Kalshi’s “rate cuts in 2025” provide real-time proxies for inflation expectations. Central-bank analysts already track these signals alongside futures curves.

Institutional feeds: Pyth’s on-chain event data enables risk platforms to build dashboards of crowd-implied probabilities across politics, economics, and sports, essentially turning sentiment into a subscription feed.

AI integration: Machine-learning agents that allocate capital or manage logistics can query these probabilities directly, using prediction markets as APIs for uncertainty.

Tokenised liquidity: The expected POLY token could introduce staking and liquidity incentives, financing market depth the same way UNI and AAVE did for DeFi.

Each case underscores the same dynamic: prediction markets are no longer about who wins an election or a game. They are about quantifying what the market thinks will happen, then selling that information as an input to finance, policy, and AI.

Why blockchain is essential

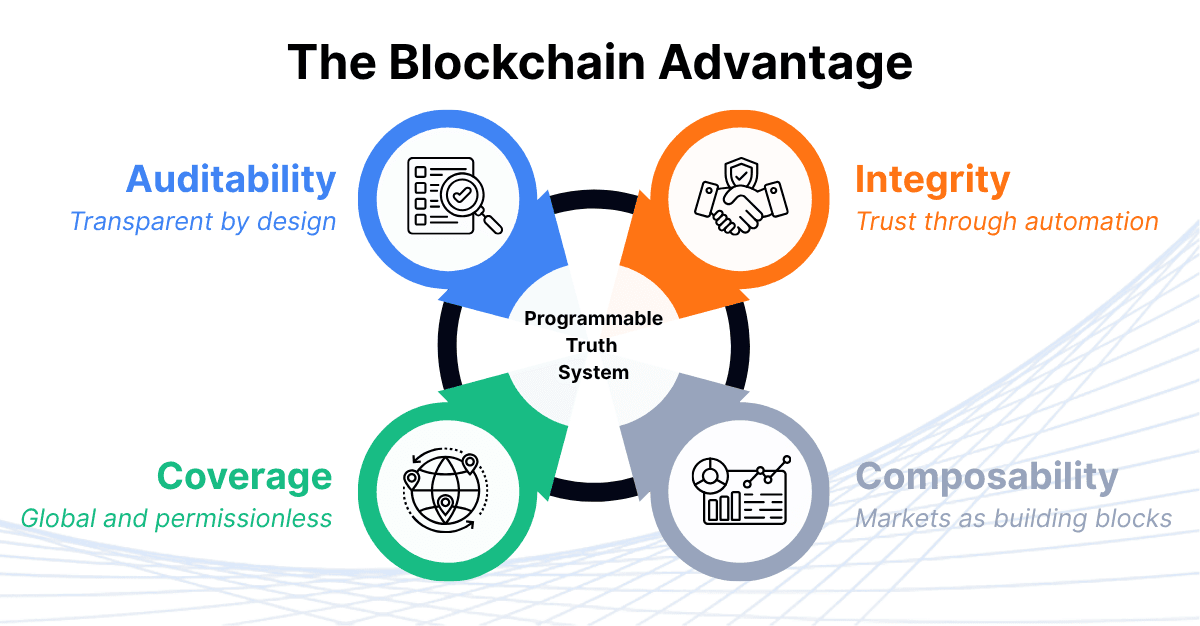

Prediction markets don’t just benefit from blockchain. They depend on it. Every serious attempt to scale them has run into the same structural barriers: trust in outcomes, interoperability, transparency, and reach.

Blockchain is the only technology that solves all four simultaneously, converting fragmented speculation into verifiable financial infrastructure.

Integrity: Outcomes must resolve deterministically. Smart contracts using oracles like Pyth, Chainlink, or UMAremove discretion risk and ensure that payouts are final. That immutability is what allows institutions to trust the data.

Composability: Standardised on-chain feeds let developers treat market probabilities as building blocks for new instruments: CPI-linked notes, “number of Fed cuts” tranches, or hedges against policy or weather shocks.

Auditability: Public ledgers provide a verifiable history of trades and resolutions. During volatile events such as election nights or CPI releases, cryptographic provenance matters more than polished interfaces.

Coverage: Decentralised architecture allows long-tail markets, from local elections to AI-model ship dates, that centralised exchanges wouldn’t list. Liquidity can still pool through automated market makers and incentives.

Only blockchain meets all four requirements simultaneously. It turns prediction markets from speculative experiments into programmable truth systems: a data layer where outcomes are both priced and provable.

What to Watch

Several developments will show how far prediction markets have advanced:

Hybrid venues bridging TradFi and DeFi Regulated exchanges are beginning to stream event data directly onto public blockchains, merging traditional oversight with on-chain transparency.

Event-probability indices and structured products As data becomes the product, expect aggregated market odds to be repackaged into investable instruments, similar to volatility or macro-surprise indices.

Tokenised collateral Event contracts are likely to adopt on-chain assets such as USDC or tokenised Treasury bills for margin and settlement, improving efficiency and reducing counterparty risk.

Bonded and auditable governance systems Institutional adoption will hinge on transparent dispute resolution, often managed through bonded oracle systems such as UMA’s Optimistic Oracle.

Risks and Constraints

The foundations are in place, but the path to maturity is still being built. Scaling prediction markets into credible, institutional-grade infrastructure will depend on solving practical constraints around liquidity, oracle integrity, and regulation.

Shallow liquidity outside major events: Most volume clusters around high-profile markets, leaving smaller ones thin and prone to manipulation.

Oracle dependencies: Even decentralised oracles can introduce latency or data errors; reliable redundancy and governance remain critical.

Regulatory compliance and legitimacy: As institutional interest grows, so does the need for robust KYC and AML standards. Clear compliance frameworks will determine which platforms gain regulatory approval, user protection, and access to traditional capital, which are the key ingredients for mainstream adoption.

Prediction markets are entering the mainstream, but their success will depend on balancing transparency with compliance and proving that on-chain infrastructure can support institutional-grade trust.

The takeaway

Polymarket and Kalshi are travelling different routes toward the same destination. One starts with decentralisation seeking regulatory trust; the other starts with regulation seeking decentralised reach. Both are converging on an industry where prediction data itself is a financial product, and blockchain is the only infrastructure capable of making that product reliable, composable, and global.

The golden age of prediction markets will be on-chain because only on-chain systems can make collective foresight an investable asset.