Tokenisation

Welcome to this week’s Tranched newsletter.

In this issue, we examine what the Bank of England’s recent comments on tokenised collateral signal and why they matter as part of a longer, deliberate shift in financial market infrastructure.

We look at how the BoE has been approaching blockchain and digital assets over time, what changes when tokenised instruments start interacting with central bank liquidity frameworks, and why this plays a key role in on-chain securitisation’s move from experimentation toward institutional relevance.

Over the past year, conversations around blockchain, tokenisation, and on-chain settlement have moved away from speculative possibility and toward something more concrete. Not because of a single breakthrough, but because regulation, infrastructure, and institutional behaviour have started to line up.

Last week’s comments from the Bank of England (BoE) about exploring the use of tokenised assets as collateral landed into that context. On their own, they might sound incremental, however, when viewed alongside everything else the BoE has been working on, they start to look more like part of a longer arc.

Viewed in context, the announcement invites a deeper question about what is really changing beneath the surface: What is the Bank of England actually building, and how much of this represents real change versus careful signalling?

What was announced?

At the end of January , the Bank of England confirmed it is considering whether a broader range of tokenised assets could be accepted within its collateral framework, potentially expanding the set of instruments eligible for central bank liquidity operations.

The language followed a familiar pattern: cautious phrasing, no hard commitments, and an emphasis on further analysis. That caution is consistent with the approach the Bank has outlined in its progress reports and consultation papers on digital finance.

The announcement sits alongside BoE’s ongoing formal programmes on digital securities, stablecoins, and ledger-based settlement.

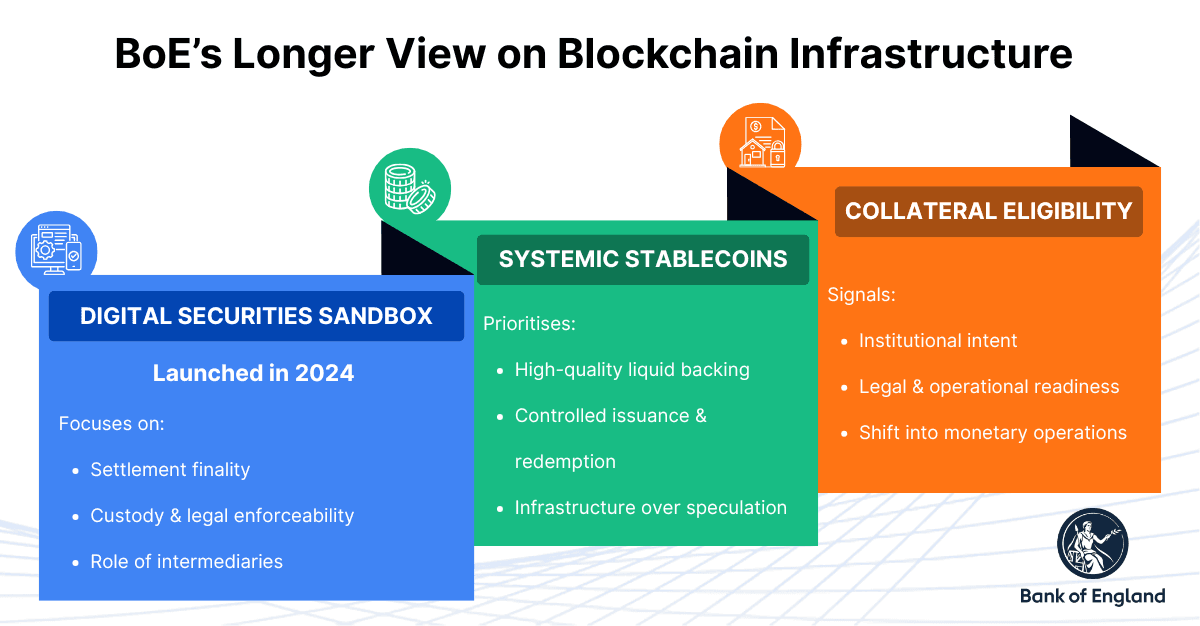

The BoE’s Longer View on Blockchain Infrastructure

Rather than backing a single technology, the BoE has taken a deliberately multi-track approach. Over the past few years, it has been testing how different components may or may not fit together.

#1 Digital Securities Sandbox (DSS)

The Digital Securities Sandbox, launched in 2024, allows regulated firms to issue, trade, and settle securities using digital ledgers under temporary legal modifications.

The goal isn’t speed or efficiency alone. The DSS is designed to surface practical questions around:

Settlement finality

Custody models

Legal enforceability

The role of traditional intermediaries

Essentially, its goal is to understand the flexibility of existing market structures in regards to the introduction of DLT.

#2 Stablecoins as infrastructure, not consumer crypto

The BoE’s proposed regime for systemic sterling stablecoins reinforces the same philosophy.

The framework prioritises:

High-quality liquid backing (primarily UK government debt)

Tight controls on issuance and redemption

A clear distinction between payment infrastructure and speculative instruments

This suggests the BoE sees stablecoins less as a consumer product and more as a potential settlement layer for regulated finance.

#3 Collateral eligibility: where theory meets balance sheets

Collateral frameworks tend to get less attention, but they’re often where institutional intent becomes clearest.

Exploring tokenised assets as eligible collateral doesn’t mean they’ll be widely accepted tomorrow. What it does indicate is that questions around legal form, operational risk, and control are now being asked seriously enough to justify internal work.

For market participants, that shift matters because it brings tokenisation into the realm of monetary operations.

What This Means in Practice

If tokenised assets begin to feature in collateral frameworks, we can expect to see several flow-on effects:

On-chain issuance and securitisation become relevant to funding desks, not just innovation teams

Custody, settlement, and compliance move closer to core infrastructure decisions

Tokenised assets start interacting with real liquidity, rather than remaining confined to secondary markets

This is where blockchain infrastructure starts to resemble plumbing.

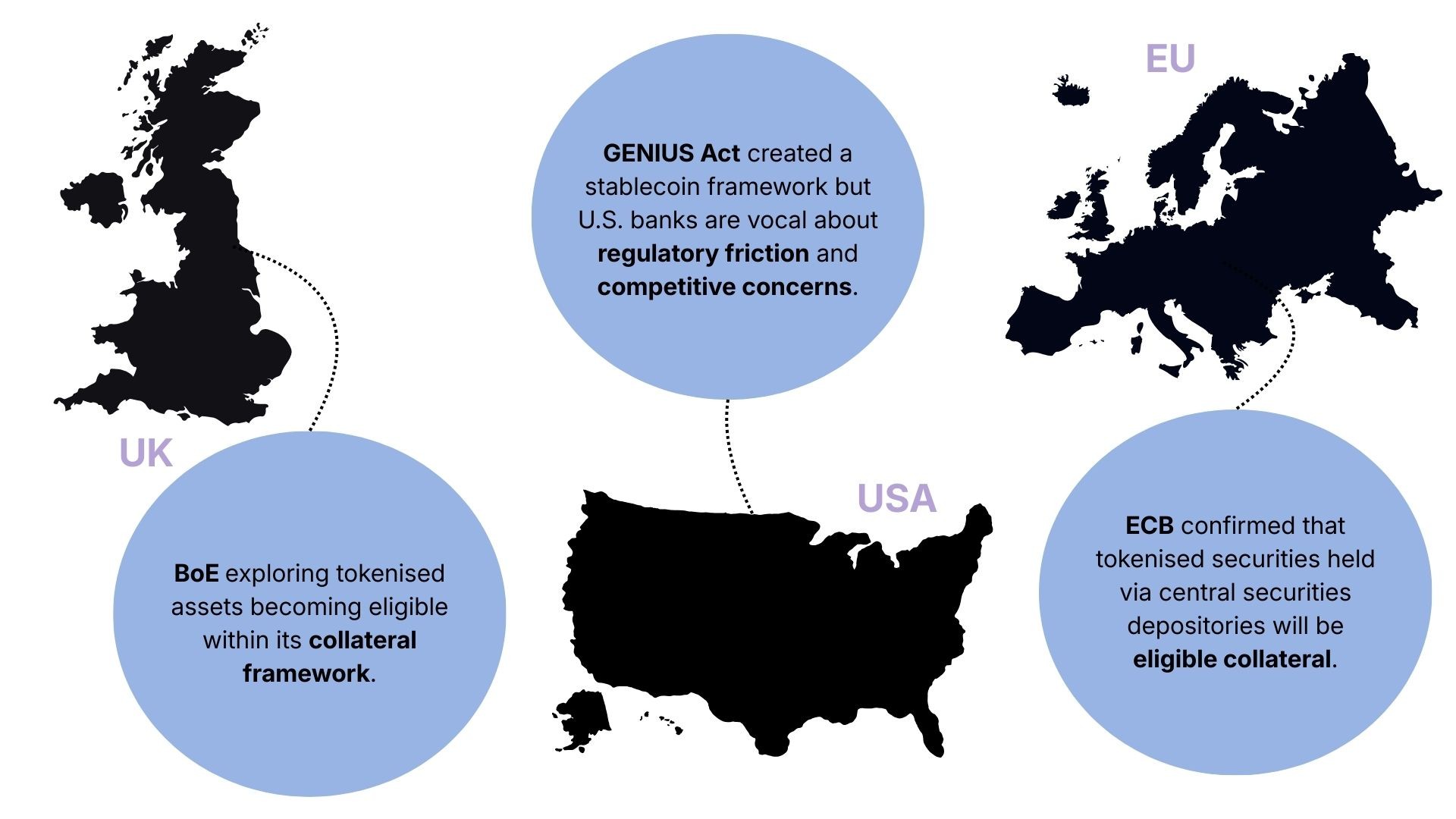

How does this compare to Europe and the US?

In Europe, the ECB has confirmed that tokenised securities held via central securities depositories will be eligible collateral for Eurosystem credit operations from March 2026 .

Europe’s approach is methodical and harmonised, though often slower to iterate.

In the U.S., the contrast is sharper. While federal legislation like the GENIUS Act has created a stablecoin framework, U.S. banks have been far more vocal about regulatory friction and competitive concerns.

Where the UK has leaned into structured collaboration, the U.S. has seen a more adversarial dynamic between regulators and incumbents.

Let’s Zoom Out

In terms of industry reaction, many UK institutions appear cautiously supportive. The sandbox model gives banks and asset managers a way to engage without committing balance sheets prematurely.

Public enthusiasm remains muted. Infrastructure shifts of this kind tend to happen quietly, long before they show up in volumes or headlines.

Will this result in widespread adoption? The scale remains limited. But central banks rarely invest sustained effort in areas they do not expect to matter, and from that perspective the Bank of England’s direction of travel looks like groundwork rather than a headline grab.

As central banks continue down this path, on-chain securitisation stops being a theoretical upgrade and starts becoming a plausible extension of existing market infrastructure.