DeFi

Welcome to this week’s Tranched newsletter.

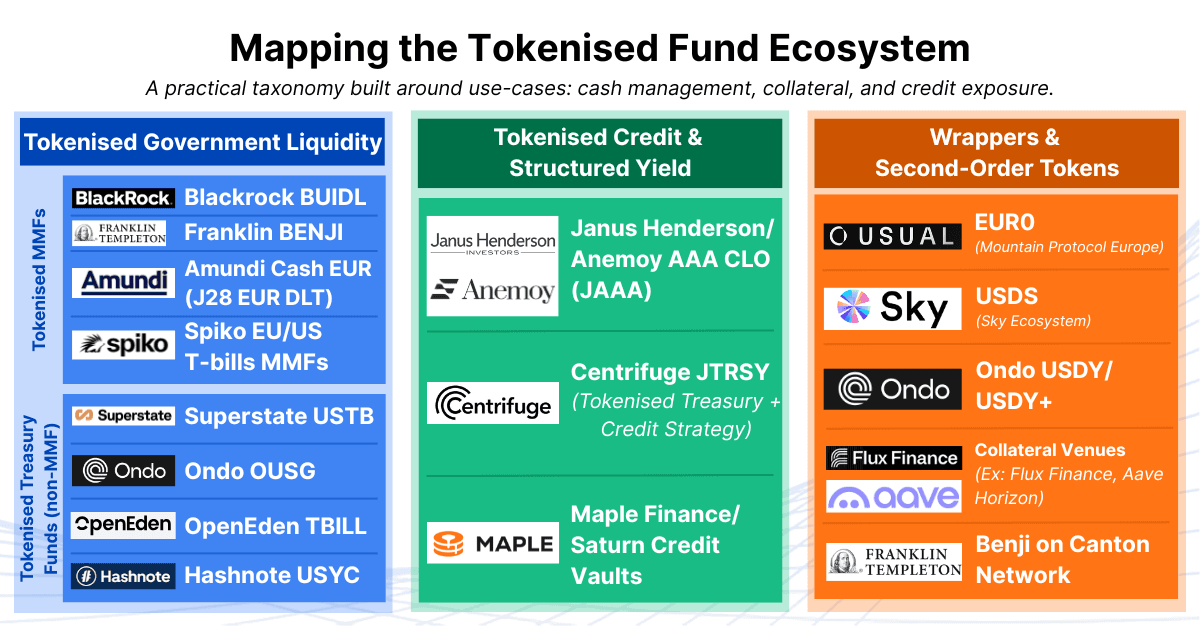

This edition maps the fast-growing landscape of tokenised funds and traces how they are rewiring liquidity, collateral flows and risk across on-chain markets.

Tokenised funds have become one of the clearest ways to understand how yield is moving on-chain. Growth has been rapid, but the category itself is often described in broad terms that hide a more complicated reality. These instruments behave differently, serve different users, and rely on different regulatory frameworks. Industry labels such as “tokenised treasuries”, “tokenised MMFs” or “tokenised credit funds” map only part of the picture.

A more useful frame is to follow what each product actually does in the market. Some provide cash-like liquidity. Others provide collateral for stablecoins. A smaller group provides credit exposure that becomes relevant as the interest-rate cycle turns. This newsletter traces those functional roles and links them to the underlying data. The goal is to give a clearer view of how the tokenised yield stack works today and where its next constraints are likely to appear.

1. From experiment to infrastructure

Real-world assets (RWA) on public blockchains have gone from a curiosity to a market of roughly $35B in 2025. Multiple analyses using RWA.xyz data put current on-chain RWA value around $30B, with growth of around 8–10% over the last month alone.

Within that total, short-term government liquidity products dominate:

RWA.xyz tracks over $9.2B in tokenised Treasuries, bonds and cash-equivalent products.

The Bank for International Settlements (BIS) estimates that tokenised money market funds (TMMFs) grew from about $770M at end-2023 to almost $9B by October 2025, more than 10x increase.

At the same time, we are seeing:

Institutional-grade Treasury funds such as Superstate’s USTB and Ondo Finance’s OUSG;

Tokenised MMF-type products such as Franklin Templeton’s BENJI and BlackRock’s BUIDL;

New tokenised credit funds, notably Janus Henderson Investors’s Anemoy AAA CLO strategy (JAAA), with a $1 billion allocation anchored by the Sky ecosystem.

All of these instruments show up under the headline “tokenised funds”. In practice, they serve different economic functions, and they fall under separate regulatory regimes that shape how they can operate on-chain.

The rest of this piece tries to do something simple but missing from most commentary: map the tokenised yield stack by what sits underneath and what it is used for.

2. A working taxonomy: think in buckets, not labels

From a practitioner’s perspective, three buckets are emerging:

Tokenised government liquidity funds: Cash-like exposure to short-term sovereign bills and government repos.

Tokenised credit and structured-yield funds: CLOs and other credit portfolios, often targeting spreads over the risk-free rate.

Wrappers and second-order tokens: Stablecoins and aggregator funds whose backing consists largely of bucket (1) and (2).

Regulators will continue to distinguish between US ’40-Act MMFs, UCITS vehicles, AIFs and private funds because each sits within a different supervisory framework. But if the goal is to understand how the market functions on-chain, including how collateral circulates, how liquidity pressure spreads and where yield originates, it is more helpful to group these products by their underlying assets and by the part of the on-chain stack they support.

That is why you will see, for example:

BUIDL treated here alongside BENJI and Amundi, as part of the government liquidity bucket, even though it is technically a US institutional digital liquidity fund (MMF).

OUSG treated as a tokenised Treasury fund wrapper, even though it increasingly allocates into other tokenised funds such as BUIDL.

JAAA (Anemoy AAA CLO) clearly placed in the credit / structured bucket, despite having its own dedicated on-chain vehicle.

As a result, the framework below focuses on economic function rather than legal form, in order to clarify how collateral moves, how liquidity builds up and where yield actually originates in the on-chain market structure.

3. Bucket 1 – Tokenised government liquidity

3.1 Tokenised money market funds (TMMFs)

The Bank for International Settlements – BIS defines TMMFs as shares in money market funds that invest in short-term money market instruments, often concentrated in government securities, but which circulate as tokens on public blockchains. They pay returns at money-market rates and are generally regulated as securities or funds rather than as payment instruments.

Concrete examples:

BlackRock BUIDL (BlackRock USD Institutional Digital Liquidity Fund): A tokenised institutional money market fund investing in short-duration US government debt and repos. BUIDL has become the largest on-chain TMMF, with around $2.3–2.9B in tokenised assets.

Franklin Templeton BENJI / Franklin OnChain U.S. Government Money Fund: A US government MMF where each share is represented by a BENJI token. The fund invests at least 99.5% of its assets in US government securities, cash and fully collateralised repos, with strict maturity and WAL limits consistent with MMF regulation.

Amundi Funds Cash EUR (J28 EUR DLT): Amundi, one of Europe’s largest asset managers, recently tokenised a share class of its €5B euro liquidity fund, AMUNDI FUNDS CASH EUR, on Ethereum. The underlying remains Amundi’s euro money market fund investing in short-term euro-denominated money market instruments.

Spiko T-Bills MMFs (EU and US): Spiko runs EU-registered short-term VNAV MMFs that invest 100% in euro-area or US T-bills plus repos. These funds have fully tokenised registries, daily NAV on-chain and are already used as reserve assets for stablecoins such as EUR0.

Together, these institutional tokenised MMFs account for most of the growth the BIS tracks in tokenised money market funds, as existing MMFs are effectively ‘lift-and-shifted’ onto public or permissioned chains and then plugged into repo, collateral and DeFi workflows.

3.2 Tokenised Treasury funds outside MMF regimes

Sitting adjacent to TMMFs are Treasury funds that look economically similar but are not regulated as MMFs:

Superstate USTB (Short Duration U.S. Government Securities Fund): A private fund for Qualified Purchasers whose ownership is represented by the USTB token. It invests in short-duration US Treasuries and agencies, targeting returns in line with the Fed funds rate, but is structured as a private fund rather than a retail MMF.

Ondo Finance OUSG (Tokenised US Treasuries fund): OUSG is a tokenised fund that invests primarily in BUIDL and similar liquidity funds, giving on-chain exposure to U.S. Treasuries while functioning as a Treasury-fund-of-funds rather than a classic money-market fund or single-instrument instrument.

From a balance-sheet perspective, these products all sit in the same part of the curve: short-dated, high-grade sovereign exposure with minimal credit risk. From a regulatory perspective, they span US ’40-Act MMFs, UCITS MMFs and private funds.

This is why it is useful to place them together in a government liquidity bucket: they serve broadly the same role in treasury management, collateral and “cash-like” DeFi positioning, even though the paperwork differs.

4. Bucket 2 – Tokenised credit and structured yield

As rates peaked in 2023–24, simple T-bill products were enough to outperform most DeFi lending markets. That is changing. In a rate-cutting environment, spread products regain relevance.

The most visible example on-chain is:

Janus Henderson Investors Anemoy AAA CLO Fund (JAAA) - A fully on-chain AAA CLO strategy managed by Janus Henderson and Anemoy via Centrifuge. In June 2025, the Sky (formerly MakerDAO) ecosystem approved a mandate of up to $1B for the Anemoy AAA CLO strategy via the Grove protocol, one of the largest tokenised credit allocations announced to date.

Economically, JAAA gives exposure to an AAA tranche of a CLO backed by senior secured corporate loans, with floating-rate coupons. It aims to deliver yields above money-market rates primarily by taking credit and structural risk rather than duration risk.

Two points matter for practitioners:

Cycle-sensitivity – As front-end rates fall, the relative appeal of AAA CLO spreads increases. Tokenised CLO funds turn that into a programmable, composable asset that can be used as collateral in protocols like Sky/Grove.

Risk transmission – Unlike T-bills, CLO tranches embed correlation and convexity. In benign conditions they behave like “better cash”. Under stress, spread widening, model risk and structural features (OC/IC tests, waterfalls) can introduce non-linear behaviour.

Products like JAAA anchor the “credit” segment of the tokenised fund landscape. They behave differently from tokenised cash instruments, and their risks and incentives ripple through the market in different ways.

5. Bucket 3 – Wrappers and second-order tokens

On top of these funds sit stablecoins and aggregators whose reserves are largely invested in bucket (1) and (2).

Three patterns stand out:

Stablecoins backed by tokenised funds - A) Euro-denominated stablecoins such as EUR0 explicitly hold Spiko’s EU T-Bills MMF (euTBL) as reserve collateral and B) In the Sky ecosystem, reserves routed via the Grove protocol are being allocated into tokenised credit strategies such as JAAA, alongside tokenised Treasury funds, to support USDS yield and balance sheet returns.

Yield-bearing “cash” wrappers - Products like Ondo’s OUSG or Superstate’s USTB are tokenised Treasury funds that can be used as collateral or as building blocks for structured stablecoins and leveraged strategies, creating a second layer of claims on the same underlying government securities.

DeFi collateral integrations - A) TMMFs such as BUIDL and BENJI are increasingly treated as collateral: Binance now accepts BUIDL as off-exchange collateral for institutional trading, while Franklin’s Benji platform is being wired into networks such as Canton to support use of tokenised MMF shares as collateral and liquidity and B)At the same time, Aave’s Horizon market and similar initiatives allow tokenised Treasury and credit funds (USTB, USCC, JRTSY, JAAA) to be posted directly as RWA collateral to borrow stablecoins.

Functionally, these wrappers mean that the same pool of T-bills or CLOs may support multiple layers of leverage: the fund itself, the stablecoin or derivative token that wraps it, and any further rehypothecation in DeFi.

This is where the story stops being about “on-chain yield innovation” and starts to look like familiar questions from securities financing and MMFs, only with different plumbing.

6. How this rewires global yield

Putting the three buckets together, a clearer narrative emerges:

Phase 1: Search for safe yield - In 2023, DeFi lending rates on stablecoins fell well below front-end risk-free rates. Tokenised T-bill products filled the gap, pulling institutional cash and crypto treasuries into on-chain T-bill and MMF structures. CoinGecko and others estimate that tokenised Treasuries grew from under $1B in 2022 to around$5.5B by early 2025, with BUIDL alone taking a ~45% share in that segment.

Phase 2: From cash management to collateral - As assets scaled, tokenised funds shifted from behaving like “better cash” to becoming foundational collateral across on-chain markets.

Phase 3 – Adding credit and leverage With the launch of strategies like JAAA, and the integration of these funds into stablecoins and leverage protocols, the on-chain yield curve now includes true credit premia and structured products, not just tokenised bills.

The result is a stacked system:

Government liquidity → tokenised funds → stablecoins / wrappers → DeFi collateral and leverage.

Together, these phases show how on-chain markets have moved from passively mirroring traditional instruments to actively reshaping how yield is sourced, transmitted and reused. For industry professionals, the key analytical question is not whether tokenisation works, but how this architecture behaves under stress.

7. Risk and regulation: what professionals should watch

Regulators are already drawing parallels with money market funds and stablecoins.

Three themes recur across BIS, FSB and IMF work:

Liquidity mismatches and run dynamics: TMMFs and Treasury funds offer daily (or near-instant) liquidity on top of assets that, in practice, rely on wholesale market functioning and repo capacity. The BIS warns that concentration in a handful of large TMMFs, combined with permissioned wallets and reliance on public chains, could accelerate stress if redemptions spike or if on-chain liquidity evaporates.

Interlinkages with stablecoins and private credit - The IMF’s 2025 GFSR and the FSB’s tokenisation report both highlight the growing interdependence between tokenised funds, stablecoins and credit markets. Tokenised MMFs and stablecoins are increasing demand for short-dated sovereign bills; more complex tokenised credit could affect how shocks transmit along the curve.

Regime boundaries and cross-border supervision - A US ’40-Act MMF whose shares circulate as tokens, a Luxembourg UCITS liquidity fund on Stellar, and a private Delaware Treasury fund represented as an ERC-20 may all show up side by side in a DeFi collateral pool. For supervisors, that raises questions about which regime actually constrains behaviour, and how quickly risk can migrate across borders if tokens move faster than legal structures.

For practitioners building on top of these instruments, the implication is straightforward:

You cannot rely on labels alone - “Tokenised MMF”, “Treasury fund”, “liquidity fund” or “RWA token” each hide very different risk, governance and liquidity profiles.

The more these products are reused as collateral and backing for stablecoins, the more important it becomes to understand the stack two or three layers down.

8. The Path Ahead for Tokenised Yield

The headline story is no longer that traditional finance is experimenting with blockchain. That phase has passed. We now have a market where:

Institutional cash management is shifting on-chain, with growing use of tokenised money-market funds and Treasury funds as daily liquidity tools.

Stablecoins and DeFi protocols increasingly depend on these funds for reserves, collateral and liquidity, embedding them into core settlement flows.

Structured credit strategies such as tokenised CLOs are beginning to layer genuine, cycle-sensitive risk premia on top of the base of tokenised T-bills and MMFs.

Tokenised funds are beginning to shape how liquidity, collateral and yield move across both traditional and decentralised markets. The foundations being built today will determine how these instruments behave when scale meets stress.

In a market where transparency, interoperability and real-time verification matter more with each cycle, the real differentiator is the technology that can support that transition without compromising stability. The next chapter of tokenised finance will be shaped by the systems that carry the weight.