Knowledge

Welcome to this week’s Tranched newsletter.

In this edition, we synthesise the latest 2026 outlooks from asset managers, banks, and market infrastructure research to extract what actually matters for private credit, securitisation, and financial rails. The result is five structural insights shaping how credit markets are evolving as we head into 2026.

We read the 2026 outlooks so you don’t have to.

Five structural shifts shaping private credit, securitisation, and financial rails.

In the past two months alone, BlackRock, McKinsey, JP Morgan, Fidelity, Galaxy, CoinShares, Bitwise, a16z, Coinbase Institutional, and VanEck have all published their 2026 outlooks.

Different mandates, different audiences, different incentives.

Yet, when you strip away price targets, asset-specific forecasts, and crypto-native narratives, a surprisingly tight overlap appears, particularly around private credit, securitisation, and financial infrastructure.

Below are five insights that consistently surfaced across these reports, reframed specifically for professionals operating in structured credit, ABS, and capital markets infrastructure.

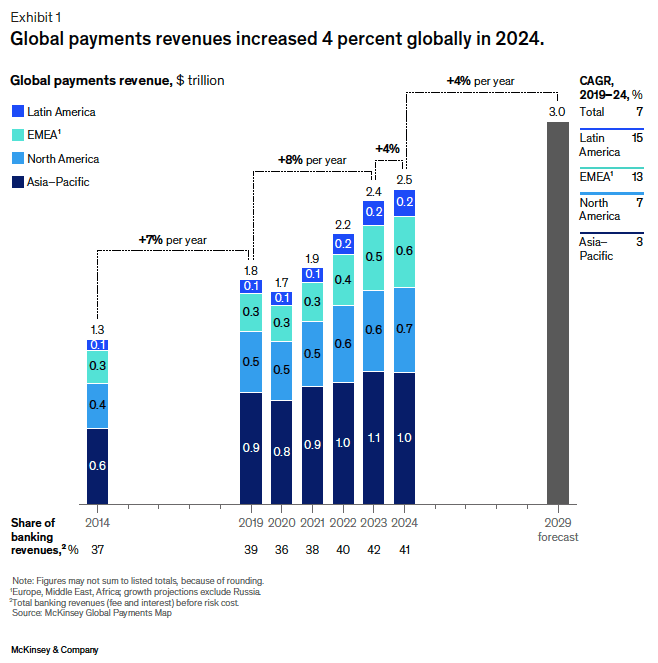

1. Financial cash flows are becoming continuous, increasing velocity and financeability

Across all the reports, one shift is explicit or implied: financial activity is moving from batch-based to continuousexecution.

This shows up consistently as:

Stablecoin settlement operating 24/7 rather than end-of-day

Tokenised funds enabling same-day or intraday subscriptions and redemptions

Treasury operations shifting from static buffers to dynamic liquidity management

Payments, settlement, and reconciliation happening in smaller, more frequent increments

CoinShares and Galaxy show stablecoin transaction volumes growing far faster than underlying GDP. BlackRock and Fidelity highlight tokenised funds and digital settlement as tools for intraday liquidity movement. McKinsey frames payments as becoming always-on rather than episodic. Messari and a16z describe on-chain finance as increasing the frequency of financial actions, not just reducing cost.

The common outcome is not fragmentation or consolidation per se. It is higher cash-flow velocity and observability.

Why this matters :

As finance becomes continuous rather than batch-based, liquidity management moves from periodic to constant.

Instead of funding large obligations at predictable intervals, firms now manage many small, time-sensitive cash movements across settlement, treasury, and funding operations. This increases the velocity of cash without necessarily increasing balance-sheet size.

For credit markets, this creates a structural shift:

More short-duration financing needs

More frequent refinancing and rollover events

Greater demand for infrastructure that can observe and intermediate cash flows in real time

Over time, this favours financing models that can operate continuously, rather than episodically.

Source: MicKinsey & Company, The 2025 Global Payments Report, Exhibit 1

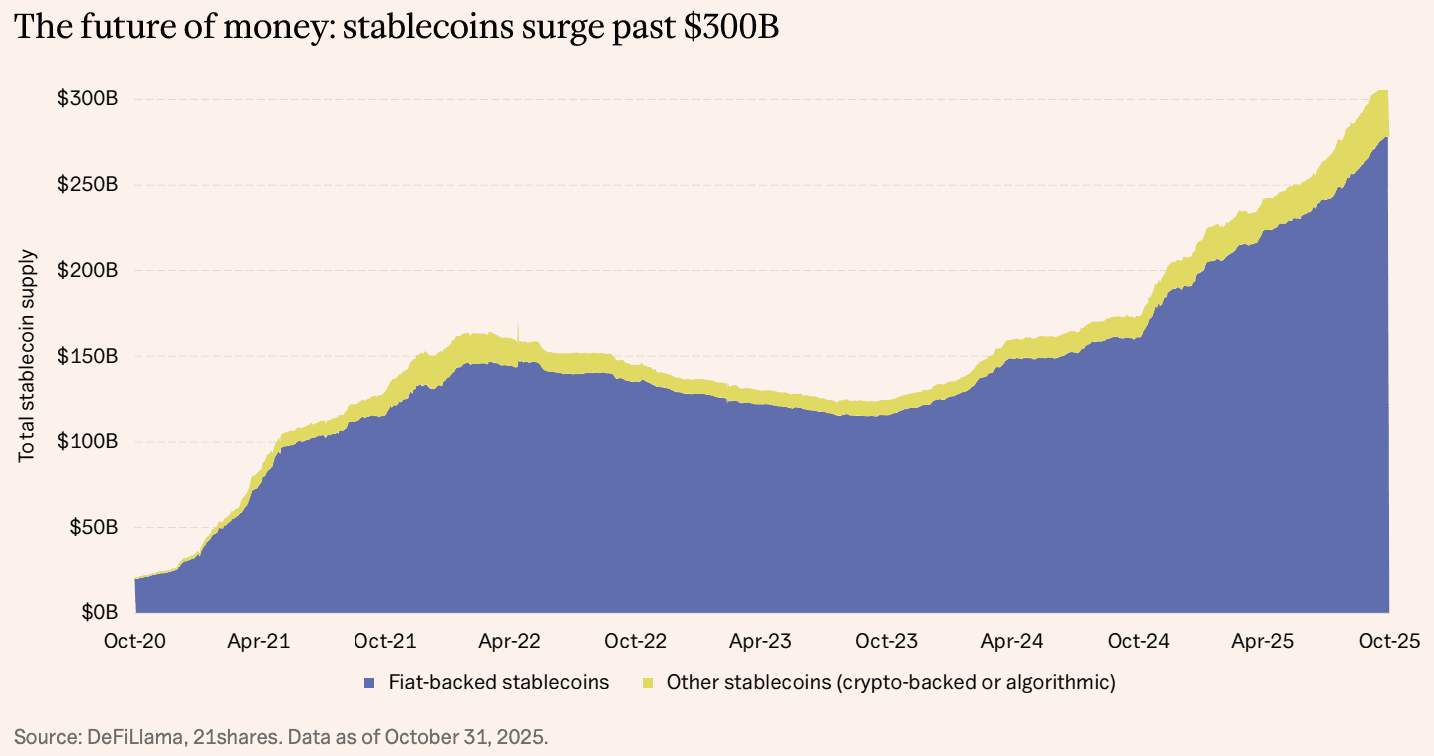

2. Stablecoins are increasingly embedded inside balance sheets, not user interfaces

Across CoinShares, Galaxy, Fidelity, and Coinbase Institutional, stablecoins are no longer framed primarily as a consumer payment product.

The data points tell a different story:

Global stablecoin supply has exceeded $300B and is projected to reach $1T by end-2026

Monthly stablecoin transaction volumes already exceed $700B

Over 90% of institutional respondents in payments surveys report active stablecoin integration initiatives

Crucially, much of this usage is invisible to end users:

Corporate treasuries holding stablecoins as operating liquidity

Payroll and settlement flows abstracted behind traditional UX

Yield-bearing stablecoins sourcing returns from private credit and RWAs rather than sovereign bills

For structured credit, this changes the funding stack:

Stablecoins increasingly act as settlement cash within financing structures

Liquidity buffers move closer to asset-level cash flows

Funding becomes more continuous rather than batch-based

Why this matters:

When the liability side of a credit structure settles natively on programmable rails, settlement cycles compress and prefunding needs fall.

This reduces operational risk premiums embedded in warehouse lines, improves capital efficiency, and enables more frequent refinancing and upsizing. Over time, this supports tighter spreads and higher asset turnover for private credit strategies.

Source: 21Shares, State of Crypto 2026, Figure 3

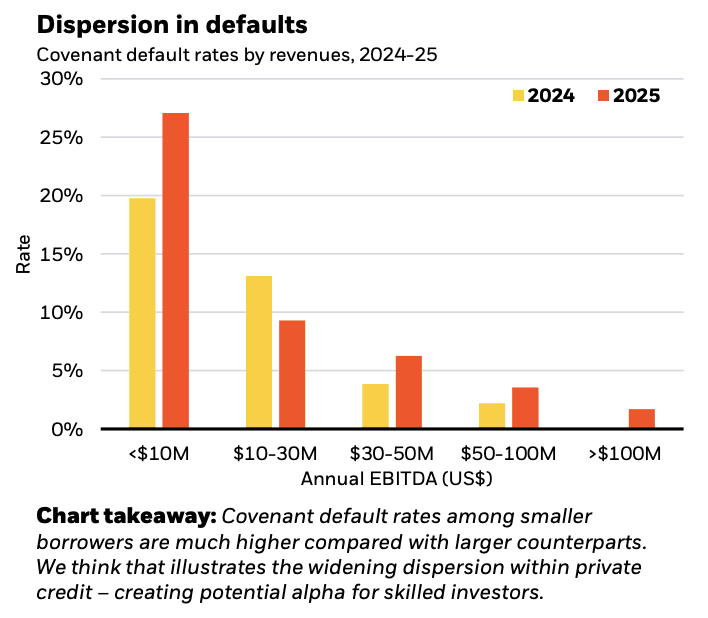

3. Private credit scaling is increasingly constrained by operational transparency

Virtually every outlook agrees that private credit continues to scale. What is more revealing is where constraints are emerging.

Across CoinShares, Galaxy, and Fidelity:

Private credit and tokenised credit volumes more than doubled in 2025

Demand for floating-rate, short-duration exposure remains strong

Yet NAV facilities, warehouse lines, and securitisations are increasingly gated by data quality and reporting latency, not investor appetite

McKinsey complements this by showing that financial platforms are monetising reconciliation, reporting, and working-capital tooling, not balance-sheet risk.

Blockchain infrastructure enters here as operational middleware:

Continuous asset-level reporting

Automated cash-flow waterfalls

Real-time covenant monitoring

Why this matters:

Operational opacity now directly translates into higher funding costs. As private credit portfolios scale and diversify, manual reporting and periodic verification become economically untenable.

Infrastructure that reduces non-credit risk allows originators to refinance faster, issue more frequently, and access a broader investor base, directly affecting IRRs and portfolio velocity.

Source: BlackRock Investment Institute, 2026 Global Outlook

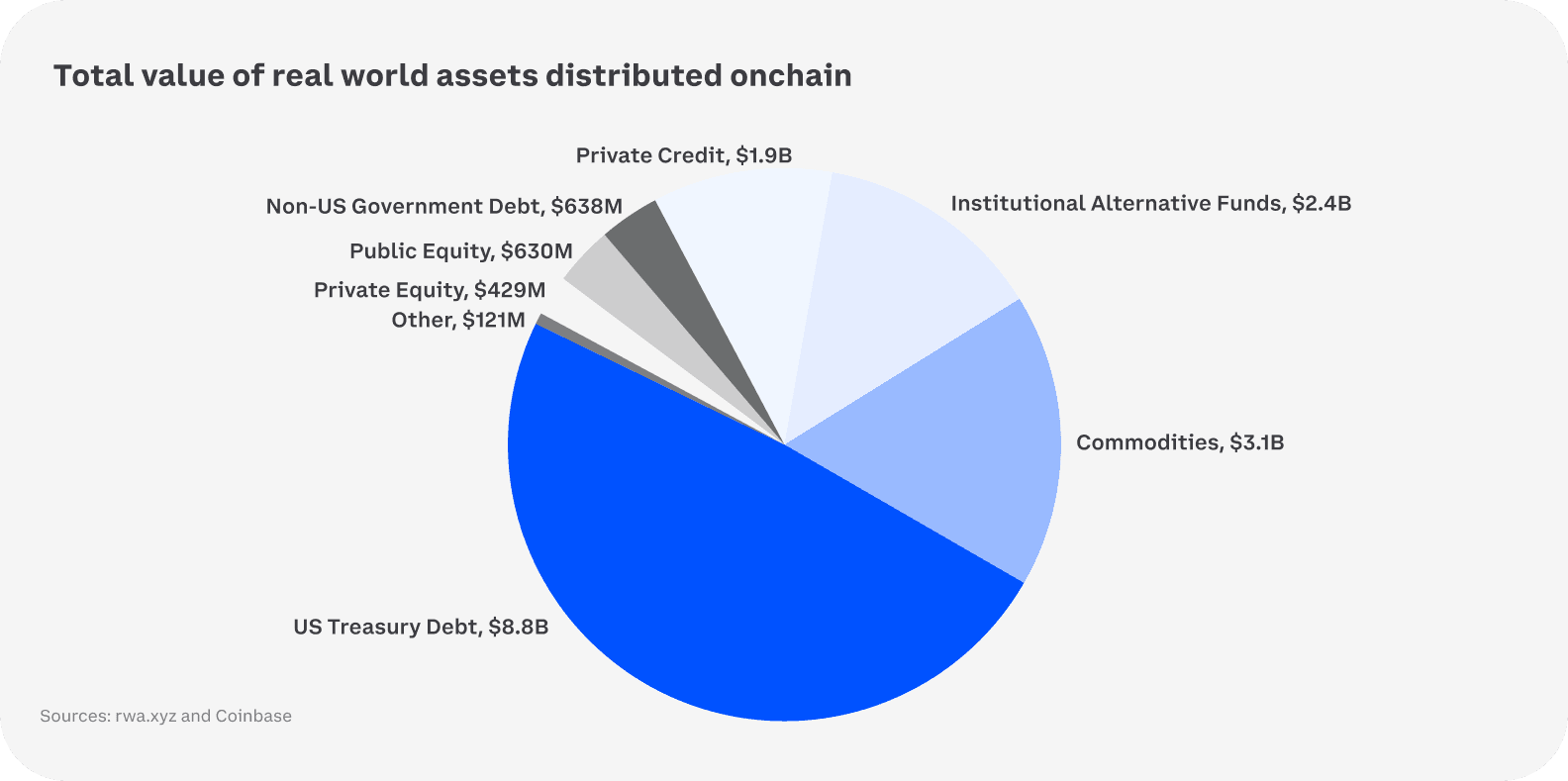

4. Securitisation is re-emerging as a continuous distribution mechanism

Several reports explicitly point to securitisation’s renewed relevance, but the mechanism is often implicit.

CoinShares and BlackRock highlight rapid growth in tokenised funds, MMFs, and private credit vehicles, while McKinsey emphasises the need for faster settlement, better reporting, and modular liquidity management across capital markets.

The link between securitisation and tokenisation is operational:

Tokenised infrastructure enables continuous asset performance visibility

Programmable waterfalls automate post-issuance servicing

Digital settlement rails reduce issuance and refinancing friction

This supports a shift from:

Large, infrequent securitisations to

Smaller, more frequent, and faster-cycling issuance programmes

Why this matters:

Securitisation becomes more scalable when it behaves like infrastructure rather than a project.

Continuous monitoring lowers servicing risk, shortens issuance timelines, and enables dynamic capital stack management. This is particularly relevant for granular private credit and receivables portfolios where traditional securitisation costs are prohibitive.

Source: Coinbase Institutional, 2026 Crypto Market Outlook, "Total value of real-world assets distributed onchain"

5. Institutional adoption is consolidating around programmable financial rails

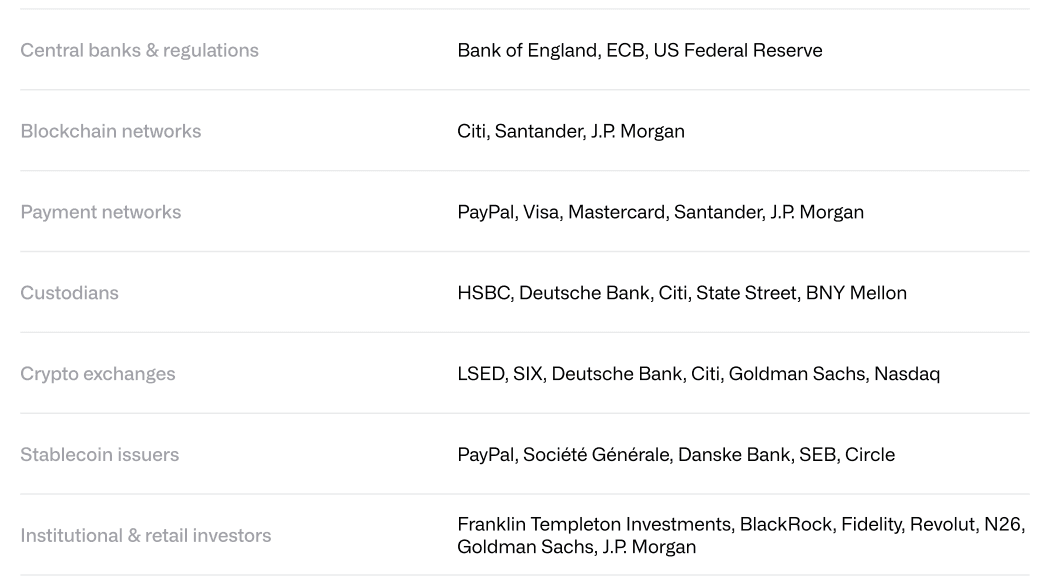

Across BlackRock, McKinsey, Fidelity, JP Morgan, and CoinShares, institutional adoption follows a consistent pattern.

Institutions are not adopting crypto products. They are adopting:

Tokenised deposits

Stablecoin settlement

Programmable collateral

Automated compliance and reporting

Source: CoinShares, 2026 Outlook: Digital Assets Move from Disruption to Integration

McKinsey frames the future as competition between payment and settlement architectures, while CoinShares explicitly describes 2026 as the year digital assets move from disruption to integration.

For structured finance, programmable rails enable:

Faster settlement and refinancing

Lower operational risk

Tighter coordination between originators, servicers, and investors

Why this matters:

Operational reliability is becoming a competitive differentiator.

As capital markets modularise, institutions that operate on programmable rails gain speed, transparency, and cost advantages.

Over time, this reshapes underwriting standards, servicing models, and investor expectations in private credit and ABS.

Bottom line: 2026 is the year structured credit becomes infrastructure

Across every serious 2026 outlook, one conclusion is consistent:

Capital markets are becoming more modular, more programmable, and more infrastructure-driven.

Private credit, ABS, and securitisation are not being displaced. They are being re-engineered around better rails.

The firms that win this transition will not be those chasing the next asset class, but those building the infrastructure that allows credit to scale with transparency, speed, and trust.

That is the layer Tranched is focused on.