DeFi

Welcome to this week’s Tranched newsletter.

The conversation around tokenised real-world assets is gaining momentum, and the recent exchange between Figure and DeFiLlama has brought renewed attention to the challenge of valuing RWAs within DeFi.

In this week’s edition, we examine how off-chain structures intersect with on-chain transparency, and what this means for the future of tokenised finance.

A recent disagreement between Figure and DeFiLlama has highlighted a broader question for the market: how should tokenised real-world assets be valued, and what role do off-chain structures play in DeFi?

The recent controversy was sparked when Figure, a leading tokenization platform, challenged DefiLlama, a prominent data aggregator, over its refusal to list Figure’s reported real-world asset values on industry leaderboards. Figure’s founders argued that their methodology, which integrates legal and custodial records into on-chain representations, deserved recognition. DeFiLlama responded by raising concerns about the verifiability of off-chain data and emphasizing its commitment to counting only transparently on-chain assets. The exchange underscores a deeper issue that every participant in on-chain finance must grapple with: where do we draw the line between on-chain transparency and off-chain trust?

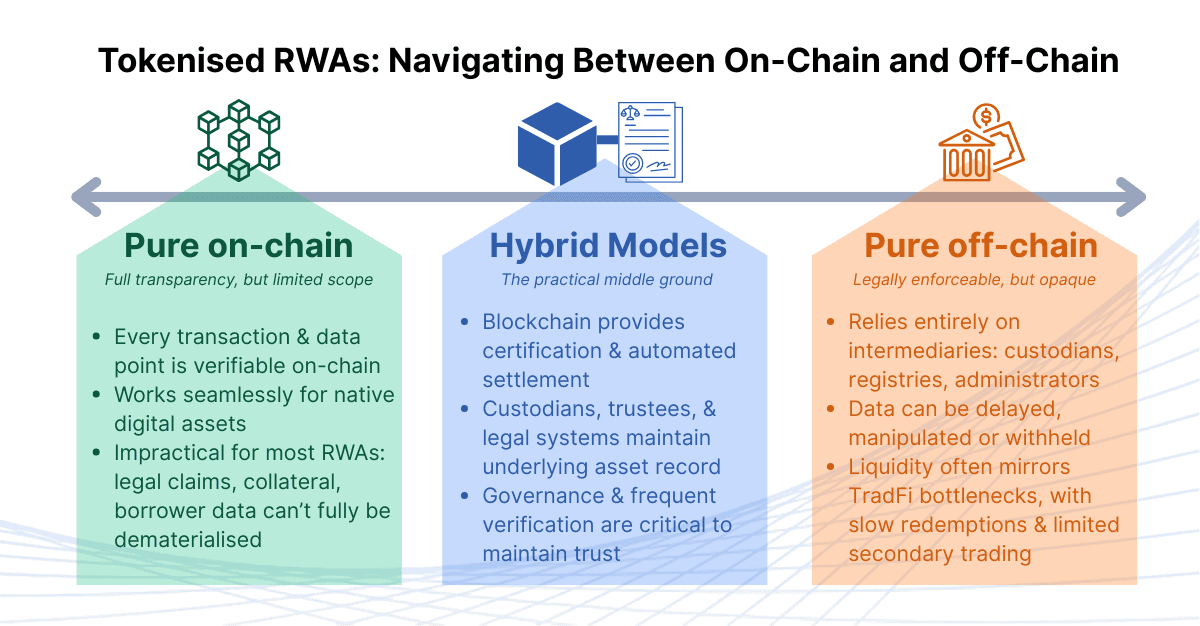

At its core, DeFi’s promise is verifiability. Smart contracts and blockchain ledgers allow any participant to see collateral, transactions, and ownership without relying on intermediaries. When assets are natively digital (ex. stablecoins, governance tokens, liquidity positions), this system works seamlessly. But as soon as RWAs come into play, a gap opens.

A token representing a bond, a loan, or a piece of real estate ultimately depends on information maintained by off-chain custodians or registries. That data is not natively transparent. Investors are asked to trust legal systems, trustees, or reporting agents, even if the final settlement occurs on-chain. As a result, the Figure–DeFiLlama exchange highlighted how easily disagreements can emerge over what counts as “verifiable” when off-chain infrastructure is involved.

Disagreements like the one between Figure and DeFiLlama highlight the core tension in tokenised finance: valuing real-world assets that rely on off-chain data within systems built for on-chain transparency.

Tokenised RWAs depend on custodians, legal records, and data feeds that can be delayed or manipulated, raising concerns that blockchains may present flawed information as immutable truth. Liquidity is another weak spot, with thin markets and redemption bottlenecks that often resemble traditional systems rather than DeFi’s promise of open composability.

Yet fully rejecting off-chain structures isn’t feasible. Most real assets can’t live purely on-chain. Hybrid models have therefore emerged as the middle ground, using blockchains as certification and settlement layers while keeping sensitive or complex data off-chain, a trade-off that lowers costs and ensures scalability but requires careful governance to maintain trust.

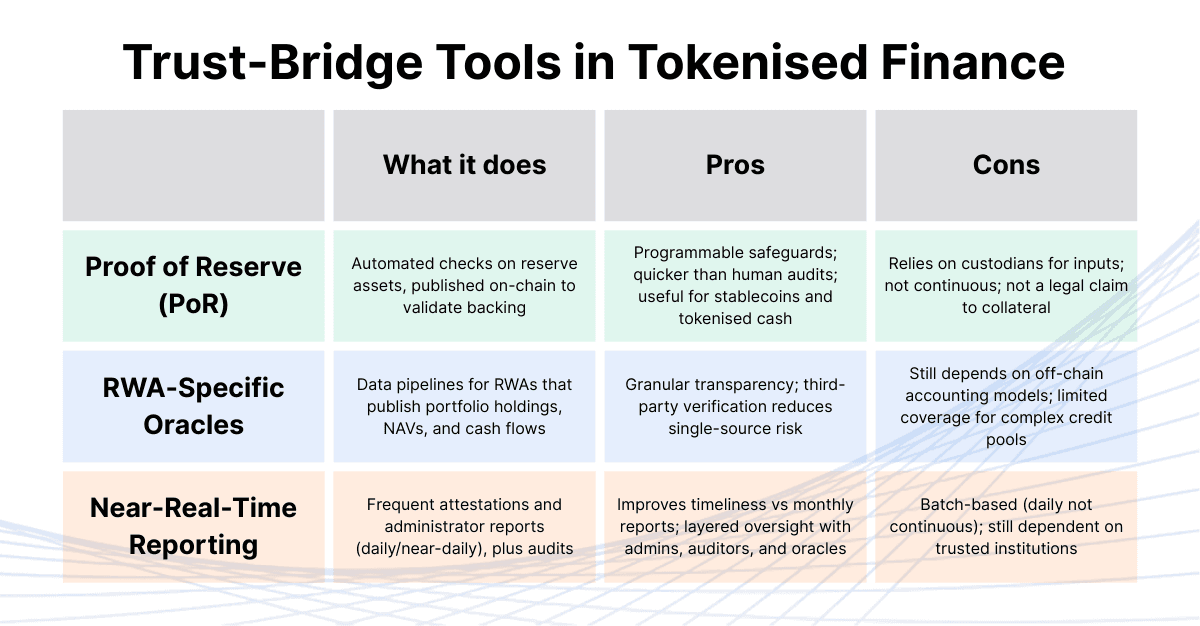

The key question, then, is how to reduce the trust gap between off-chain and on-chain. Emerging tools are starting to play this role. Proof-of-Reserve mechanisms, RWA-specific oracles, and near real-time reporting frameworks help sync legal ownership with digital tokens. While these systems are not perfect, they represent progress towards aligning off-chain complexity with DeFi’s ethos of transparency.

The valuation of RWAs will remain contested, because it sits at the intersection of two worlds: the cryptographic certainty of blockchains and the legal complexity of traditional finance. As tokenisation grows, disagreements like the one between Figure and DeFiLlama will continue to surface.

But perhaps that is the point. These debates are markers of an industry maturing.

The real question for all of us is:

🔵 How much off-chain trust is acceptable in a future on-chain world?

🟠 What kinds of verification or governance frameworks would make you comfortable with RWA valuations?

🟢 And do we prioritise scale and access, or absolute transparency?