DeFi

Welcome to this week’s Tranched newsletter.

This edition explores where crypto and AI most clearly converge: payments. We look at how protocols like x402 are turning blockchain infrastructure into the financial backbone for autonomous agents.

The most meaningful overlap between crypto and AI may not be in trading algorithms or synthetic tokens. It’s in payments. As AI agents begin to act autonomously online, they need a way to pay for services, data, and compute in real time. Coinbase and Cloudflare’s new x402 standard proposes an answer: an open protocol for internet-native payments that allows agents to transact directly using stablecoins.

Its emergence marks a broader shift in how value moves online, one that connects blockchain’s existing infrastructure with AI’s growing need for continuous, automated transactions. In this edition, we unpack what x402 is, how it works, and why it signals the point where crypto and AI begin to converge in practice.

Why x402 Exists

Web engineers reserved HTTP 402 (“Payment Required”) back in 1999 for an internet with digital cash and micropayments. For decades, it sat unused. Now, Coinbase (with Cloudflare) revived HTTP 402 with x402, an open standard that lets APIs, content, and services demand payment directly through HTTP using stablecoins.

Why is that so important in 2025? Because AI agents, not humans, are increasingly becoming the primary actors in digital workflows. Those agents don’t pause, sleep, or require user approval at every click. They run continuously. To enable them (to let them transact, pay for compute, fetch data, or access services) you need a payments layer without manual friction.

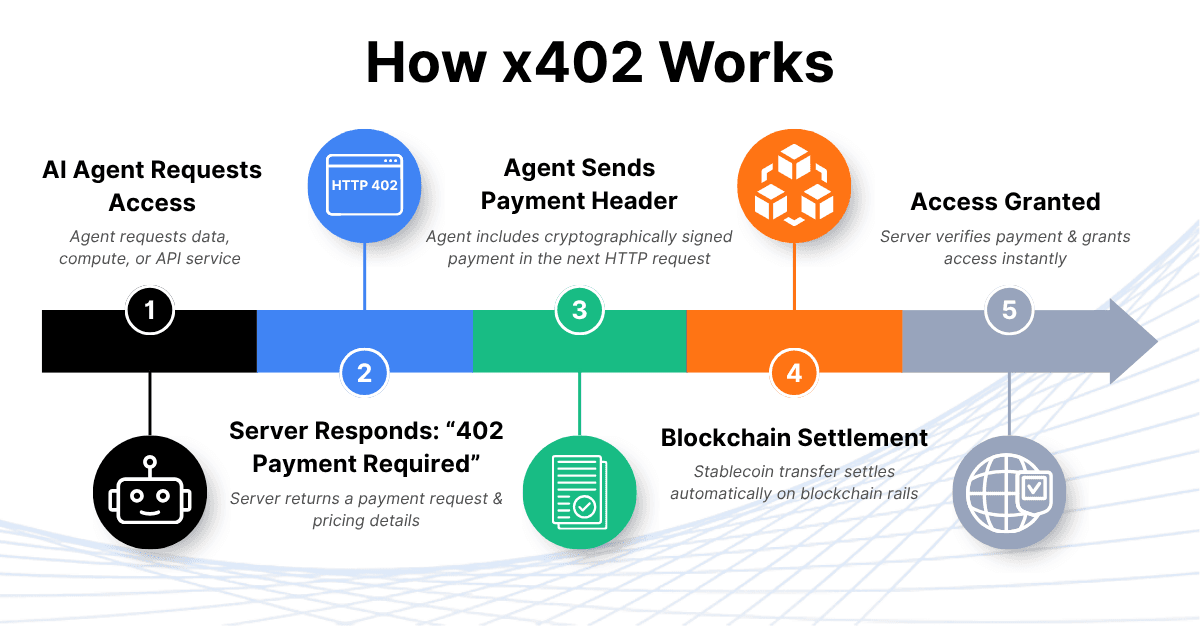

x402 addresses this by embedding payments directly into HTTP requests. When a server returns a “402 Payment Required” response, the requesting agent can include a cryptographically signed payment in the next request header. Settlement occurs automatically on blockchain rails, typically using stablecoins for price stability.

This mechanism turns payments into part of the internet’s request–response cycle, enabling machine-to-machine and agent-to-agent commerce.

The Blockchain Foundations Beneath x402

The foundation that allows x402 to function comes directly from advances in blockchain and digital asset infrastructure. For years, the idea of machine-native payments was conceptually appealing but technically out of reach. Progress in crypto has changed that equation.

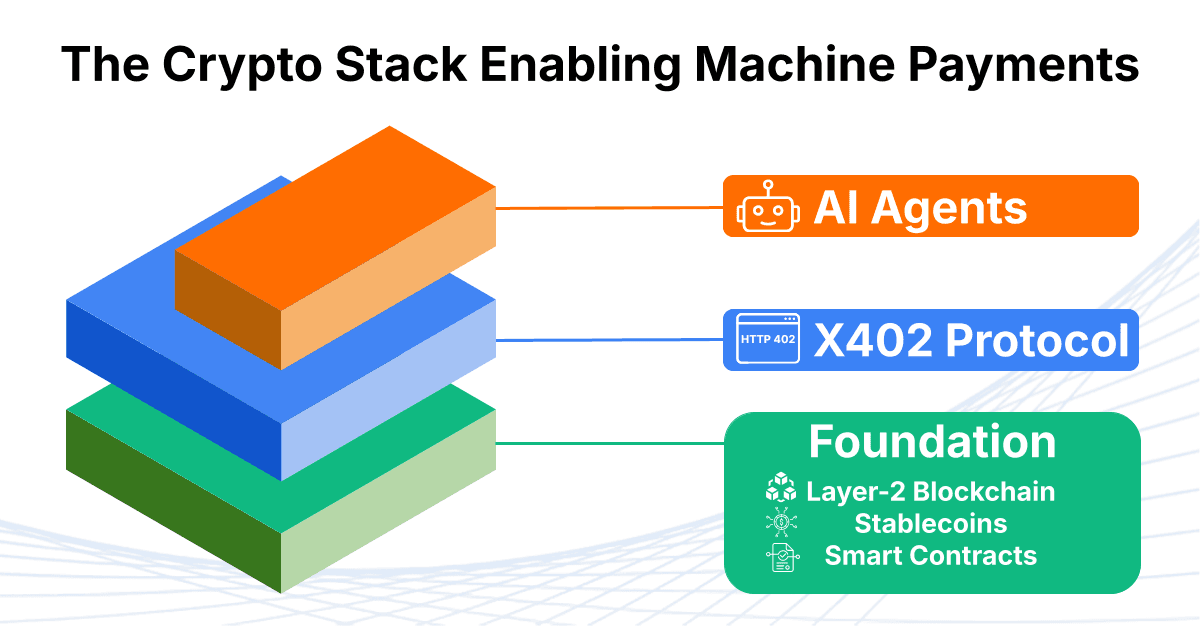

Layer-2 blockchains have made transaction costs negligible. What once cost dollars now costs fractions of a cent, allowing payments at the smallest possible scale, which is a prerequisite for agent-to-agent microtransactions.

Stablecoins provide price stability and instant settlement. Their on-chain liquidity and dollar-pegged design make them a practical medium of exchange for automated payments, ensuring agents can transact without exposure to volatility.

Smart contract platforms enable programmable, composable settlement. Agents can now interact with pre-defined payment logic (e.g. executing transfers, refunds, and conditional access automatically and transparently).

Together, these innovations form the economic and technical base that AI agents can build upon. x402 represents the bridge: it takes these crypto primitives and integrates them directly into the web’s communication layer, turning blockchain infrastructure into the financial backbone for machine-to-machine commerce.

The Emerging Use Cases Where Crypto Meets AI

The use cases emerging around x402 illustrate how advances in blockchain infrastructure have finally made machine-native payments viable. This is feasible because of crypto’s evolution in three key areas: low-cost settlement, programmable logic, and stable-value assets.

Data and content access Blockchain-based payments enable granular, per-unit pricing. Instead of subscriptions or flat fees, agents can pay a few cents (or fractions of a cent) to access specific datasets, APIs, or individual pieces of content. This structure depends on blockchain rails that can process microtransactions economically and transparently.

Compute and service payments In AI workflows, agents frequently need to pay for compute, storage, or inference. Stablecoins allow those payments to happen instantly and predictably, while smart contracts handle usage-based billing automatically. Without stable, on-chain assets and programmable settlement, this level of precision would be impossible.

IoT and machine coordination As connected devices exchange resources such as energy, bandwidth, or data, they require a trustless method to compensate one another. Blockchain systems offer that foundation, ensuring verifiable settlement without central intermediaries.

These applications form part of a broader category increasingly referred to as agentic commerce: economic activity conducted by autonomous systems on behalf of users or other agents. Coinbase describes x402 as a bridge between this emerging AI-driven ecosystem and the crypto infrastructure that enables it.

Other efforts are moving in the same direction. Google’s AP2 (Agent Payments Protocol) introduces a standard for authorisation and cross-agent payments, where x402 could serve as the value-transfer layer. Development teams are also building agent wallets and SDKs to manage permissions, identity, and stablecoin custody, while researchers explore the governance and liability implications of non-human economic actors.

These initiatives point toward a shared objective: creating a financial internet where both humans and AI agents can transact seamlessly.

Future Outlook

x402 demonstrates how the maturity of blockchain infrastructure is enabling new categories of economic activity. The same elements that underpin today’s crypto markets (programmable settlement, stable-value assets, and transparent ledgers) are the mechanisms that make autonomous, machine-to-machine payments feasible.

Still, several challenges stand in the way of broad adoption. Questions around identity and accountability remain unresolved: who bears responsibility when an autonomous agent transacts? Security risks and the potential for compromised agents introduce new vectors for misuse, while regulatory frameworks such as KYC and AML have yet to account for non-human economic actors. Beyond these, adoption depends on network effects: both service providers and agents must implement the protocol before meaningful liquidity emerges.

In this sense, x402 is not only a technical milestone but also a test of coordination. Its progress will likely begin within contained environments (enterprise APIs or specialised agent ecosystems) before expanding to the broader internet. What began as blockchain infrastructure for human transactions is now evolving into the foundation for agent-driven commerce. It is here, at the intersection of crypto and AI, that the next phase of digital payment innovation is likely to unfold.